The Tapeworm Corporation Comes Out of the Closet

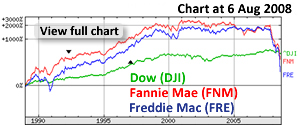

(Comparison Chart: Freddie Mac, Fannie Mae and the DOW, 1989-2008)

Eisenhower warned us about a military industrial complex. I have read that he had originally included Congress in his speech, referring in a draft to a Congressional-military-industrial complex.

What he was describing was the ability of Congress to legislate private profits – to vote dollars for government purposes that would go straight through government agencies into the coffers of private corporations and through those corporations into the private pockets of corporate management and private investors.

Eisenhower must have had an inkling where this was all going when Bechtel proposed to him as President that their private corporation be permitted to own nuclear weapons. (See the very excellent Friends in High Places: The Bechtel Story by Laton McCartney) As a soldier, unskilled in manipulating financial markets, I doubt he could fathom all the various methods and schemes “the complex” has employed since that time to transfer government and household resources to corporate control.

The big mistake, of course, had preceded Eisenhower. That was the creation of the Federal Reserve System in 1913, who was to turbo-charge the central banking-warfare model that had defined the Anglo-American Empire for centuries. Central banks print money to pay armies and navies. Armies and navies make sure the money is honored and profitable markets and cheap resources are accessible. And around and around we go.

Authorizing a group of private bankers to issue our currency, hoard our financial data and run the federal government accounts, including the Exchange Stabilization Fund, the mother of all slush funds, created a financial system engineered to advantage the large banks and financial centers at the expense of diversified production and markets. The wealth those bankers engineered into private investors’ pockets during WWI and WWII institutionalized the American financial addiction for weapons purchases and defense contracts that so deeply frustrated Eisenhower.

Eisenhower was also up against the profit to be had through a second financial mechanism that supported the transfer of vast amounts of public resources into private companies — the black budget. The National Security Act of 1947 and the Central Intelligence Agency (CIA) Act of 1949 together created a way for Congressional appropriations to be secretly diverted to non-transparent projects, creating a new flow of real estate, services and supplies to be procured from private companies.

Long after Eisenhower’s warning, in 1980, an executive order expanded Executive Branch authority to outsource sensitive work to private contractors. With little or no disclosure or Congressional oversight, the spigot for corporate armies and intelligence agencies was turned on full throttle. Better yet these mechanisms could be used – behind the protection of national security – to run numerous highly profitable, illegal activities. An additional benefit was technology transfer. To my knowledge, no one has ever priced out the extraordinary benefits to private corporations and investors to be paid on a risk-free basis by the government to learn and manage the most valuable technology in the world. I will bet you $1 it is an amount worth more than the US national debt – even after adding another $5 trillion to bail out Fannie Mae and Freddie Mac.

The best, however, was yet to come. Marry the back-door financial mechanisms with the black budget, pour money into this unholy union through federal appropriations and credit and leverage the schemes with financial tools made possible by advanced, state of the art computers and telecommunications, such as securitization and derivatives, and – voila! – you have the ability to keep thousands of corporations and banks alive, funded and profitable despite the fact that many of them have absolutely no economic reason to exist.

Increasingly, revenues and share price of the corporations and banks in this military-industrial complex depend on more rules and regulations that guarantee them market share or drive their smaller, more efficient competitors out of business. They have the ability to trade the markets and make strategic decisions with inside information. They can use government money to take them out of their private positions and mistakes. Like the Joy of Cooking cookbook, the recipes for personal profit could fill hundreds of pages.

In Eisenhower’s day, one would have assumed that this state of corruption could not continue forever. At some point the federal government’s credit would be ruined and it would lose the ability to borrow more money. If Congress simply votes to borrow more and more money for corporations and banks and various other private interests and that money is used in ways that are not economic – that is, do not create the value necessary to pay back the debt – at some point, the game has to stop? Right?

Well, no, not necessarily. With enough weaponry, it can keep going so long as the folks with the weapons want it that way. Dick Cheney gave us the heads up when he said, “Deficits don’t matter.” We just have to use force to finance more economic waste. As we steal from the healthy to finance the unhealthy, there is more death – of people, healthy enterprises, communities, animal species and environment. The more we steal, the more dependent on stealing we become, which means the more we need to steal. The more success at stealing defines the winners, as opposed to productivity, the more people and organizations convert to stealing or to investing in those who do. It is the spiral down, not of markets but of life. It is, as one astute commentator on the environmental aspects described, “the death of birth.”

So what has evolved is a corporate and banking model to run the planet that has no connection whatsoever to fundamental economics or business. It is not efficient, it is not transparent, it does not compete and it is not productive. It has absolutely nothing to do with capitalism or free markets or free enterprise – although it claims these words for branding purposes. It has the economic benefit of fantastic increases in productivity from technology all of which have been incorporated within its control without helping the model achieve basic productivity or overall sustainability. Technology has made the corporation a more powerful financial vacuum cleaner rather than a source of real wealth. For several years, I have referred to this model as an integral part of “Tapeworm” economics. So, for easy reference, let’s refer to the model as a “Tapeworm corporation.”

The Tapeworm corporation works like this. Working alone or with others in a trade group, the Tapeworm corporation arranges for its well-paid lobbyists to write and legislate new government regulations and laws that guarantee it a market or market share. The lobbyist and various beneficiaries of the corporations largesse fund the campaign contributions that help make the system go. The corporation gets government contracts, often on a “no-bid” and “cost-plus” basis, which guarantees profits and encourages over-spending. The corporation may also make government purchases or receive industry-wide subsidies that also generate revenues or tax exemptions and benefits that shelter income. It uses government credit to attract and command global capital at low cost. The astute participant in this system can even use government enforcement to wipe out its competitors. In the worst cases, honest and ethical people in their way are forced out, harassed or killed.

If our corporation loses money, if it is a financial institution, it simply has the government or the central bank arrange more borrowings that can be loaned back to government at a built in profit or, in the worst instances, bail it out using the “too big to fail” justification. If it is a defense contractor, more contracts and purchases can be arranged. In all cases, our corporation enjoys government intervention to prop up its stock prices and debt in the open market, ensuring it a significantly lower cost of capital. The resulting profits fund rich compensation to hire the best and brightest people, field lots of lobbyists to keep the gravy train going and pour money into the coffers of foundations, universities and not-for-profits who provide affirmation of the corporate credibility. Our corporation and its leaders are great philanthropists!

A simple, clear picture of the real workings of this Tapeworm model has been challenging to communicate. The model was obscured with an enormous amount of legal and operational complexity and financial engineering. A great deal of time and effort, financed by those who most benefited, was spent spinning the illusion that the Tapeworm corporation was efficient and productive. And, in all fairness to those who have served as corporate apologists, some of what was going on was hidden behind the non-transparency of national security law and covert operations and money laundering. For those who want a detailed case study see, “Dillon, Read & Co. Inc. and the Aristocracy of Stock Profits.”

The average person could not believe that the largest, most prestigious Wall Street banks and investment houses were engaged with Washington in managing the largest capital market in the world – the US mortgage markets – on a criminal basis.

That was too much to swallow.

Until now.

The real model has come out of the closet. While the last year of Wall Street bailouts were making things clearer, the Housing and Economic Recovery Act of 2008 now leaves no room for doubt. The Act could not be more blunt about infinite government subsidy funded with infinite debt benefiting the private few. The Tapeworm corporation is in full bloom.

The American taxpayers are – in essence – guaranteeing $5 trillion of Fannie Mae and Freddie Mac debt. The Federal Reserve stands by to subsidize their stock in the stock market. Fannie and Freddie continue to pay dividends to their shareholders. When this all works out, all the profit goes to the shareholders and management. The taxpayers get no compensation or payback for saving all of Fannie and Freddie’s equity and — in essence — guaranteeing their income. The management of Fannie and Freddie get to keep all their compensation and bonuses. They get to spend as much as they want on more lobbyists and law firms. They and their foundations can continue to hand out money to universities and not-for-profits.

This all ensures that Fannie Mae and Freddie Mac can continue to use the federal credit to centralize and control the US mortgage market.

What Fannie Mae and Freddie Mac do get is a new regulator. After reading the scope of work for the new regulator outlined in the Act, it is not clear to me what authority and scope is left for their board of directors. The boards essentially have all liability and no power. The management must do whatever the regulator says and the regulator has the ability to micromanage no end, which can only be checked by a Congress that can also micromanage no end. We can reasonably expect Fannie Mae and Freddie Mac’s payrolls and partnerships to continue to expand with their market share. A lot of constituencies are likely to get fed from this new back-door spigot.

But perhaps that is only fair. After all, the federal government represents a source of infinite capital that – unlike pesky shareholders – requires no return. The government only requires that you do whatever they say, pay their friends and send financing and profit wherever they tell you.

The out-of-the-closet Tapeworm corporation is a more powerful, sophisticated version of the old Tapeworm corporations that were common in Washington housing circles – the HUD property management companies that were sometimes referred to as CIA or Department of Justice (DOJ) “proprietaries.” The management would talk as if they were in charge. The investors would talk as if they were really in charge. And the folks from the CIA would talk as if they were really in charge. At the mercy of this invisible matrix structure, the old style HUD property management company lacked clarity on missions or decisions and the resulting culture was confused and unproductive at best. It all left you scratching your head wondering who “they” really were.

The housing bill has put forward the most explicit description yet of the true corporate model prevailing in America – Congressionally legislated businesses with central bank determined stock prices.

It is a fascinating combination of friendly fascism and multiple personality disorder. Now that the fundamental nature of the Tapeworm corporation is out of the closet and clear, keeping it afloat will require a mind-numbing combination of global force to maintain financial liquidity and global propaganda and payola to preserve its brand.

In 1994, I was deep in conversation with a technologist who managed our server security and firewalls for my investment bank. We started to talk about what would happen as the explosion in information and communications technology increased the learning metabolism within the economy. At one point he got up to call a physicist he knew at Lawrence Livermore Laboratory to ask him what happened when the learning metabolism rose in a system. After conversing with the physicist, he returned with this warning. He said, “When the metabolism rises, the rate of entropy increases.”

Read Parts I, II, III, IV, V , VII, VIII, IX of this commentary >>>

View all parts of the article here >>>