The Wall Street Journal speculated today on the possibility that Blankfein will not make it as Chairman and CEO of Goldman Sachs. See “What-Ifs for Goldman Sachs: Behind Stiff Upper Lip, Some Executives, Alumni Consider Life After Blankfein.”

The article runs several trial ballons, one being that Lloyd leaves. Another is that he stays as CEO with Hank Paulson back as Chairman. A later WSJ blog post speculates about other older and wiser Goldman replacements. To make matters worse for Blankfein, the WSJ editorial page includes a piece by Thomas Frank, “Goldman and the ‘Sophisticated’ Investor” that makes mincemeat of the Goldman defense that it is ok to sell ‘sh***y’ deals to sophisticated investors.

The message in between the lines to Goldman is that if it wants to survive, Lloyd needs to go. What has Lloyd done that Mr. Global (See Goldman Whac-a-Mole) would want Lloyd gone?

The financial coup d’ etat is done. The bailout has financed out the fraudulent paper which financed the financial coup d’etat. It is time to make sure the trail is cold as we go into the consolidation phase. We don’t need lots of financial pumper and dumpers. The game of executive musical chairs is underway. We are going back to something that aligns with the real economy. Now that Mr. Global has shifted all the capital, it is time to preserve the winnings.

The core financial strategy for the coup was the strong dollar policy—the two underpinning tactics were suppressing the gold price and bubbling the mortgage market.

It was a brilliant financial scheme. The guys who engineered it were brilliant. There was Bob Rubin, former Goldman CEO at Treasury. His guy, Summers, developed the gold suppression idea when he was at Harvard. Here is the original paper. Geithner worked for them. An ambitious financial scheme and the political implementation are essential. However, getting into the trenches and figuring out the nuts and bolts of how to do it in the commodities pits and trading floors and keep it going for years, that is quite an accomplishment.

Which brings us to Lloyd Blankfein. Lloyd started by working his way up from modest beginnings. His dad was a postal clerk in Manhattan, but he made it to Harvard and Harvard Law School and landed as a tax attorney at Donovan, Leisure. He then moved to London to work in precious metals sales at J. Aron, a commodities firm that Goldman had acquired. His New York Times wedding announcement to wife Laura in 1983 describes him as a trader of precious metals with J. Aron & Company, the commodities division of Goldman Sachs & Company.

Lloyd then manages to work his way up to head of the Fixed Income Division (which includes both commodities and mortgages) which is credited as producing 35% of firm profits in 2004.

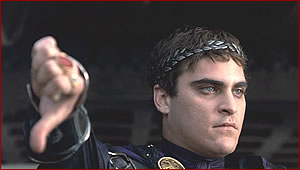

What would catapult a precious metals trader into the head of Fixed Income at Goldman Sachs and then to run the firm? Let’s face it—commodities traders have a style and a culture that is not traditionally allowed to run the board rooms no matter how much money they make.

President and COO Gary Cohn was based in London from 1993 to 1996, where he headed the Goldman Sachs Group’s global metals business before returning to work in the Fixed Income division with Blankfein. Were Lloyd and Gary the guys who made the gold suppression scheme go? And they also ran the mortgage business. Did they also lead engineering the mortgage bubble? Presumably, this would include the derivatives bubble piled on top. The gold suppression and mortgage bubble and the related derivatives were, after all, the one-two punch of the strong dollar policy.

However, it is time to move on. We have Bill Clinton running trial balloons for the gold standard and saying he was wrong to listen to Rubin and Summers. Clinton is right about one thing—the real economy cannot function productivity with the current system. We have the Administration proposing vastly increased powers for the Fed while it fights mightily in the courts for the AIG situation to stay buried forever. After all, AIG is up to its eyeballs with Goldman on building the mortgage bubble. Now we have a series of events unfolding in Europe (economic hits on Iceland and Greece, with more threatened) that would indicate it is time for the special drawing rights (SDR) system to begin to create a new global meta-currency that can continue to centralize economic control. Indeed the Swiss National Bank has called for a meeting in Zurich with the IMF shortly.

Is it time for the bankers to take back control? Is it time to get rid of the traders with their brash, arrogant ways and bury their secrets behind a mound of disgrace? Have the Swiss and the Germans finally had it with the tricksters? Is it possible that the suppression team is no longer needed?

Despite Warren Buffett’s support, Lloyd and his core team are political liabilities to Mr. Global and plans for a global currency.

Catherine Austin Fitts’ Blog Commentaries

UK FSA & US FINRA Notify Goldman of Investigations 10 May 10

GS&Co-SEC Talk Settlement 7 May 10

Spanking Buffett 7 May 10

Related reading:

Goldman Warns of More Litigation, Investigations

Yahoo Finance (10 May 10)

Goldman Sachs Shareholders Back Blankfein in ‘Important Moment’

Bloomberg.com (7 May 10)