Resources for this week’s Solari Report:

This Week’s Slides:

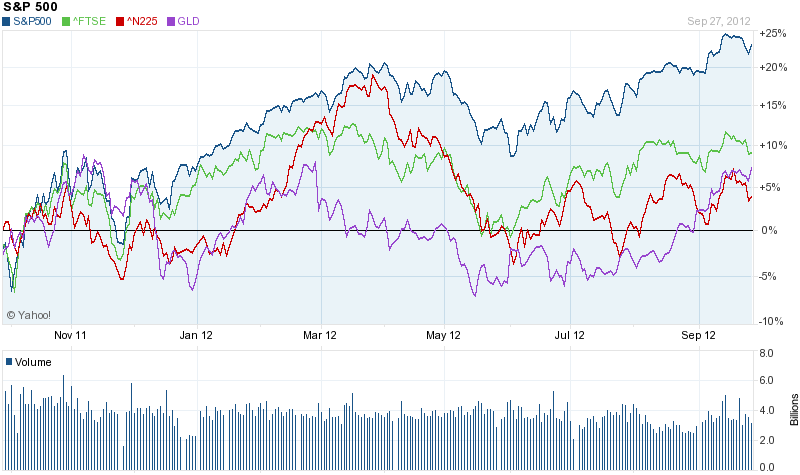

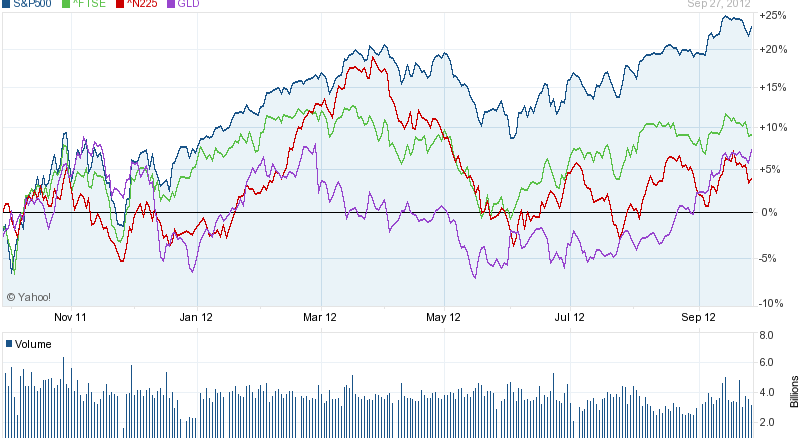

| Chart 1 | Chart 2 | Chart 3 | Chart 4 | Chart 4a |

| Chart 5 | Chart 6 | Chart 7 | Chart 8 | Chart 9 |

| Chart 10 | Chart 11 | Chart 12 | Chart 13 | Chart 14 |

| Chart 15 |

Read the transcript

Transcript of Equity Market with Chuck Gibson [PDF]

Listen to the MP3 audio file

Download the MP3 audio file

Audio Chapters

1. Introduction & Up-coming Events – 0:00

At Sea Lane – Financial Salons for Changing Times – Sebastopol, 10/20 Santa Cruz 11/14

October 12-14, 2012 Transformations & Renewals Gathering

December 1, 2012 Subscribers’ Luncheon with Catherine Murfreesboro, Tennessee

2. Theme – 1:54

Happy Days are Here Again (sarcastic)

3. Money & Markets – 3:01

In Money & Markets Catherine gives an introduction to the Fiscal Cliff and the monetary, fiscal and government policies coming or in place that will hit your balance sheet and income statement. Catherine also talks about what is happening in the Eurozone, discusses Iranian hyperinflation, and the Asian market slowdown.

4. Geopolitical – 8:00

The big news this week is the first presidential debate of the election season, which Catherine says is proof she cannot get people interested in local elections. Romney recovered some of his lost ground.

5. Science & Technology – 10:10

Catherine discusses the Google driverless car and California signing it into law.

6. Food, Health, & Education – 10:53

GMOs and their safety are still being debated in the news. Catherine also discusses the attack on teachers and education. Teacher pension funds are under attack.

7. Ask Catherine – 12:44

A response to Jon Rappoport’s report from last week.

8. Hero – 14:38

Our hero this week is former democratic pollster and analyst, Pat Caddell.

9. Interview – 15:28

Catherine is joined by Chuck Gibson, her partner in Sea Lane Advisory, LLC in the San Francisco Bay Area. They give their quarterly overview of the equity markets. Key areas Chuck and Catherine discuss are: What QE3 could mean to the equity market and you, what the “fiscal cliff” could mean to the equity markets and you, and the volatility that lies ahead. Find out more in the interview.

10. Let’s Go to the Movies! – 1:33:05

A review of the HBO film, Too Big to Fail

By Catherine Austin Fitts

This Thursday on The Solari Report: our quarterly overview of the equity markets. I will be joined by Chuck Gibson, my partner in Sea Lane Advisory, LLC in the San Francisco Bay Area.

North American equities have had quite a strong year, but it looks like that strength may be over. Earnings do not support rising prices. However, central bank interventions in the U.S., in Europe, and in Asia do. So what’s next?

Key areas Chuck and I will be discussing:

- what QE3 could mean to the equity market and you,

- what the “fiscal cliff” could mean to the equity markets and you:

- the volatility that lies ahead.

We will be using slides on the webinar software, so if you are listening live, you may want to follow along in your browser. Slides will be posted in links in the subscriber space on this blog post on Friday.

Check out my Solari Report interview with Chuck this summer “View From Silicon Valley”. It’s excellent background on the innovation and technology trends that have contributed to surprising strength in U.S. equity markets this year.

I will start with Money & Markets and Ask Catherine. Subscribers can post their questions here or live Thursday evening.

In Let’s Go to the Movies: a review of Andrew Sorkin’s fictionalized account of the 2008 bank bailouts, Too Big to Fail.

Talk to you Thursday!