By Catherine Austin Fitts

Now let’s get this straight. On December 11th, the Department of Justice announces that HSBC is paying a $1.92 billion settlement for money laundering. However, no officers of HSBC are being indicted or penalized. Everyone skates.

Now, HSBC is the custodian for the largest gold ETF in the world. Numerous questions have been raised as to whether this pool of bullion is part of the fire power being used to manage the gold markets.

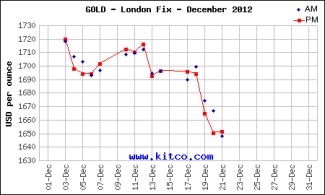

Promptly, following the announcement of the settlement, the gold price plummets. Just in time for the year-end performance calculations, we are watching gold reverse against the S&P 500.

Despite the Fed recently announcing unprecedented bond purchases for 2013, the world can sleep soundly knowing that inflation is in hand – the gold price is down. Right?

I wonder. What was the real reason that HSBC executives are untouched? Did the Department of Justice get a deal on the gold market and year-end figures as well? Are we simply watching a wider profit sharing arrangement that is replenishing the DOJ and UST slush funds?

Related Reading:

HSBC to Pay $1.92 Billion to Settle Charges of Money Laundering

Solari: GLD and SLV: Disclosure in the Precious Metals Puzzle Palace