Tuesday, 15 April 2003, 11:51 am

Column: Catherine Austin Fitts

Mapping the Real Deal…

The Real Deal About Enron

… an interview with Scoop Real Deal Columnist Catherine Austin Fitts

Part Six Of Seven Parts

By Daniel Armstrong*

Originally Published By Sanders Research Associates

[*Daniel Armstrong is a writer and novelist based in Eugene, Oregon. Mr. Armstrong is a graduate of Princeton University and attended the University of Oregon School of Journalism.]

If my years working on the clean up of BCCI and the S&L crisis taught me one thing that I would communicate today to the shareholders, retirees and employees who have been harmed, it is this: people like those on the board of Enron absolutely make money from insider trading, bid rigging and fraud, and they do so with help from the highest levels.

— Catherine Austin Fitts.

(Enron)

(Enron)

*************************

(Click Here for Part One)

(Click Here for Part Two)

(Click Here for Part Three)

(Click Here for Part Four)

(Click Here for Part Five)

In Part One, we introduced Catherine Austin Fitts and described some of her experiences in taking on the criminal powers who lie behind the modern U.S. Governmental apparatus. The Interview transcript follows in

Part Two , Part Three , Part Four and Part Five.)

*************************

CONTINUATION LINE: CAF: Pug is a key player, but ultimately he is simply a member of a syndicate that works together to make money. Financial fraud—including insidertrading—is the most profitable business on the planet. A fraud of this magnitude can buy a lot of cooperation in any market. Perhaps we will come to learn more about the syndicate as more links are discovered between Enron, Tyco, Imclone, Global Crossing, WorldCom, and other failed giants. Another player who is worth studying is Jerry Hawke, the leading US bank regulator. He worked for Robert Rubin as Jerry Hawke and friend Secretary of Treasury, now, as we mentioned, cochair of Citibank and a member of the Harvard Corporation. He also worked for Larry Summers, Rubin’s successor at the Treasury, who is now President of Harvard. Jerry Hawke was promoted to Comptroller of the Currency in 1998, which is the lead regulator permitting all this offshore bank fraud to occur uninterrupted by government regulation. But having Winokur on the Power’s Committee was like putting the fox in on the early investigation— just in time to review all the most damning materials and the most damning employee testimony. It’s possible for a process like this to organize the critical information necessary to perform the right “surgery” on Enron’s institutional memory so that the cover up design works. For example, this stuff gets shredded, this witness dies mysteriously.

DA: Enron Vice Chairman J. Clifford Baxter.

CAF: These other witnesses are now scared to death, and maybe we make the pretty girl witness a hero and even get her a book contract. These operations get sold and transferred quickly to the people who need to coordinate the cover up. And meantime, the cash gets recycled off shore and moved around as they buy time. Such in-house investigations are perfect for buying time. It’s not surprising that under oath the chairman of the Committee, William Powers, admitted in congressional testimony that they took notes for all the testimony they received from witnesses, then destroyed the notes, and produced a highly controlled written report.

DA: It’s not surprising? What do you mean?

CAF: The Powers Committee was SOP—and I will tell you how I learned that term. SOP stands for “Standard Operating Procedure.” When my company was targeted regarding our work for cleaning up HUD programs in a way that was bad for special interests, including Harvard, and presumably, the big HUD contractors such as LockheedMartin, DynCorp, JP MorganChase and Arthur Anderson, we had several situations where the DOJ and their investigators tried to falsify evidence or destroy evidence. I was dealing with a criminal syndicate.

DA: A fraternity of good old boy government contractors who’d been bilking the government for years.

CAF: We got an affidavit documenting the efforts to falsify—I mean pure criminal falsification of evidence by the DOJ investigators—and we took it to a court trustee and he looked at it and he said that this was “SOP.” I asked one of the retired HUD Inspector General auditors, “What is SOP?” He replied, “That is standard operating procedure—when you have no evidence of wrongdoing, you just try to frame an obstruction of justice charge and that is how you get an indictment.” I also asked him why the investigators kept trying to spread false rumors about my personal life, including to the government employees and my employees when they interviewed them. The retired auditor said something to the effect of “when you don’t have any facts to support an indictment, you try to brand the person as personally undesirable, and that is the fastest way to get an indictment from a DC grand jury.”

DA: Just a straight setup to discredit you and your company. When you came in and began to make HUD work the way it was designed, that was screwing with the system. For this, somebody set the DOJ to work on you.

CAF: Well, if I was to write a book called “How To Cover Up A Financial Fraud,” tactic #22 would be to get a white shoe commission, appoint some serious, very respectable guy who is totally naïve about what is really going on, make sure your ringer like Winokur is on the committee, and do a report. DA: The court appointed Atlanta lawyer Neal Batson to be the examiner in Enron’s bankruptcy. Apparently, he’s hired dozens of lawyers and consultants to seriously get into Enron’s paperwork. [18] Is this a real investigation or does Batson qualify as the “white shoe commission” you mentioned? CAF: It’s hard to determine at this point. We’ll have to watch that unfold. But in general, whether it takes two weeks or two months—twelve months and counting in the case of Enron—or two years, what it does is keeps everybody busy. It burns up time and resources, it complicates and muddles things. Properly handled, it can even help control the information flow. During the time that William Powers has got everybody busy and entertained, you’ve got Arthur Andersen shredding the documents and you’re transferring the money laundering operation over to the Swiss bank. So it’s basically a holding action—you’re buying time while you do all the things you have to do to destroy the money trail, so that you get to keep the cash. It is very interesting to look at a chronology of the Powers Committee investigation relative to the various efforts to cover up the trail of documents and money, including shredding of documents, transfer of assets and the mysterious death of one of the most important witnesses. It is quite possible that the Powers Committee was used by a player like Pug Winokur to help design and orchestrate the cover up. It is potentially a chance to review all the evidence and question all the key witnesses very early on and draw on high powered attorneys to help you figure out the cover up under the guise of “getting to the bottom of what happened.”

DA: When did you first notice Enron?

CAF: I started to look into Enron in the Summer of 2000 because I was looking for $3.3 trillion, which is missing at federal agencies including HUD—agencies that are managed in part by Pug and his pals. In 1996, a decision was made to run a covert operation to get rid of all the honest people working for or at HUD. This included getting rid of my company and me. Keep in mind that the ultimate internal financial control is to have honest people running things. This is why they had to get rid of us. One of the reasons that I know that the DOJ can take the seven steps we’ve discussed is because they used them on us—even when we had documentation proving that their own auditors and investigators concluded that we were clean as a whistle.

DA: Are you saying this goes back to your software tool Community Wizard and what was revealed simply by sorting out HUD online records? Or is this something else?

CAF: It all blends together. At this point, however, I was doing the research myself, and it turned out that the same group of contractors who run HUD—where billions of dollars are now missing, LockheedMartin, DynCorp, J.P. MorganChase, Arthur Andersen, and Harvard turn up running or deeply involved in Enron. Let’s look at the list. There is Winokur, from DynCorp, as well as a Lockheed board member, Frank Savage, on the Enron finance committee and board. JP MorganChase is an Enron creditor, Enron Online trading partner, and investor in special purpose offshore entities. Arthur Anderson is the auditor who is shredding documents and cooking books, and Pug’s partner Dudley Mecum is on the board of DynCorp and on the board of Citigroup, another Enron creditor and Enron Online trading partner. Harvard is shorting the stock at the same time that Winokur who is a Harvard Corporation member says he was not aware of problems at Enron. And Robert Rubin, former Treasury Secretary, with significant jurisdiction over HUD, federal credit and banking, is now cochair of Citigroup and now has become a member of Harvard Corporation within the week that Winokur’s resignation from Harvard Corporation is announced.

DA: Then you are clearly saying Enron was part of something much larger. Something that you discovered more or less by accident, by building placebased databases that brought sunshine to HUD’s mortgage and cash flows, neighborhood by neighborhood. That opened a very big can of very dangerous worms, resulting in the government’s smear tactics to crush you and your company.

CAF: I wasn’t a whistle blower. I was successfully reengineering HUD portfolios at the Federal Housing Administration, as I was hired and instructed by the appropriate officials to do. It’s just that immediately after they fired us and key government officials, a huge amount of money started disappearing from the accounts of all these federal agencies—and it became obvious by 2000.

IMAGE: Cartoon – The Dollarmatic

The General Accounting Office and Inspector General reports and testimony document $59 billion of undocumented adjustments at HUD in fiscal 1999, and $17 billion in fiscal 1998, and they refused to say how much in fiscal 2000. DOD has over $3.3 trillion of undocumented adjustments during the same three years. Donald Rumsfeld has confirmed that $2.3 trillion was missing in one year alone. It’s incredible when you look at it up close. The Department of Defense has failed to pro duce independent audited financial statements since the requirement went into effect in 1995. HUD’s Inspector General refused to certify HUD’s fiscal 1999 financial statements. Since both agencies have refused to explain these undocumented adjustments in adequate detail for some years and declined to report or make public undocumented adjustments, we have no evidence to document that large amounts of assets or money are not being stolen. So I was trying to figure out how you could launder hundreds of billions of dollars—stolen from the federal government—starting in the fall of 1997, because that is so much money that you can’t just run it through a pizza restaurant. You are talking about a huge amount of money and you are talking about something that JP Morgan, LockheedMartin, DynCorp and Arthur Anderson would have to be part of. Then I notice that in the fall of 1997 there is an explosion of revenues at Enron Online, and nobody can explain where the revenues came from. They just say “it’s very complicated, it’s derivatives, you know”. Well that’s ridiculous. In my experience, if you can’t explain something, then something is wrong. So I’m looking for the missing money: there is over $3.3 trillion missing from federal government agencies, starting at the exact same time, and my big question is, “Is Enron or are some of its special purpose entities part of the laundromat,” and is that why Congress is covering this up?

DA: According to Senators Kerry and Brown’s report to the Committee on Foreign Relations on the BCCI scandal, the BCCI “was made up of multiple layers of entities, related to one another through an impenetrable series of holding companies, affiliates, subsidiaries, bankswithinbanks, insider dealings and nominee relationships.”[19] If you change that to corporationswithincorporations, would that also be an accurate description of what Enron had become?

CAF: I feel like I am watching the same exact syndicates of investors and the same process—IranContra, BCCI, whatever you call it— except this time it is not real estate financed by S&L’s, they have used stock and derivatives financed by public and private pension funds. Meaning, the consequences will be far more devastating to the health and safety of average Americans. I believe our money is being stolen. Whether it’s our tax dollars, whether its our pension fund money, whether it’s the jobs that are being lost or the countless other ways this kind of “pumpanddump” fraud drains our resources and the faith and trust that are the basis of democracy in the United States. The story of Enron has a meaning. The meaning is that the federal government, the national media, the large banks and Wall Street, accounting and law firms can not be trusted to live by the standards of transparency, laws and ethics necessary to support free markets or a democratic republic.

THE STORY OF ENRON HAS A MEANING. THE MEANING IS THAT THE FEDERAL GOVERNMENT, THE NATIONAL MEDIA, THE LARGE BANKS AND WALL STREET, ACCOUNTING AND LAW FIRMS CAN NOT BE TRUSTED TO LIVE BY THE STANDARDS OF TRANSPARENCY, LAWS AND ETHICS NECESSARY TO SUPPORT FREE MARKETS OR A DEMOCRATIC REPUBLIC.

DA: The present Bush Administration is honeycombed with Enron/Andersen connections. US Trade Representative Robert Zoellick and recently released presidential economic advisor Lawrence Lindsay were on Enron’s advisory council.

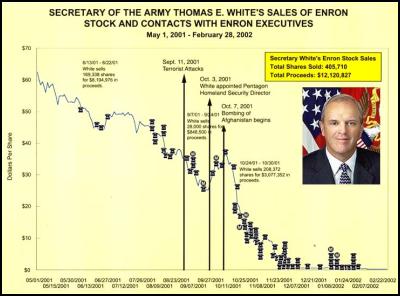

IMAGE: Thomas E. White’s Stock Sales

Graphic: J. Ward

Secretary of the Army Thomas White is a former Enron executive, who reportedly made $50 million of Enron stock sales and was overseer to Enron electricity trading operations at the time of the California energy market manipulation. Republican Party Chairman Marc Racicot was Enron’s chief lobbyist at Bracewell and Patterson. Recently resigned Securities and Exchange Commission Chairman Harvey Pitt came to Washington from the law firm that represented Arthur Anderson. In his short tenure at the SEC, he almost singlehandedly stalled congressional legislation to reform the accounting industry with inactivity and his controversial choice of William Webster to head the new accounting oversight board. Comptroller General David Walker, lead man for Congress’s financial investigation, was partner, board member, and global managing director for Arthur Anderson until 1998. Enron CEO Ken Lay is (was) a close friend of the President’s father and played an as yet undisclosed part in Vice President Dick Cheney’s National Energy Policy. Enron’s also made large political contributions to President George W. Bush and Attorney General John Ashcroft. In light of all that you said, about the S&L connections and the possibility of a DOJ cover up, what do you make of the Bush/Enron/Andersen management fraternity? Can we, in any way, imagine that these relationships are incidental?

AS LONG AS CRIME PAYS, THE VARIOUS SYNDICATE CARTELS AND THEIR MEMBERS WILL BE FUNDING OR LEADING IN GOVERNMENT. ORGANIZED CRIME TODAY IS A PUBLIC PRIVATE PARTNERSHIP. IT GENERATES THE LARGE CASH FLOWS THAT HELP DETERMINE WHO OWNS WHAT AND WHO FUNDS THE CAMPAIGNS. ULTIMATELY, THIS IS THE PROCESS THAT DETERMINES WHO IS ELECTED AND APPOINTED.

CAF: No, Virginia, there is no Santa Claus; but there is a syndicate. I dare say if Tony Soprano was the Chairman of Enron’s finance committee and his cousin worked for the Senator lobbing easy questions to the Soprano family members in front of the camera, we would all instantly have a sense of how the business model worked.

There was a syndicate or “families” that profited from IranContra. As they profited, they bought political power. How many members of the last and current Administration were implicated or indicted, even convicted, on IranContra related charges? The number is simply astonishing. Syndicate members go in and out of syndicate operations, whether it is laundering money generated by operations like Mena Arkansas or pumpanddump frauds like Harken and Enron. As long as crime pays, the various syndicate cartels and their members will be funding or leading in government. Organized crime today is a publicprivate partnership. It generates the large cash flows that help determine who owns what and who funds the campaigns. Ultimately, this is the process that determines who is elected and appointed.

What is happening is obvious; the hard part is accepting that it has been going on in front of us and we have not seen it or failed to pay attention to the symptoms. What is happening is in part a function of the power of digital computer tools and relational database technology combined with telecommunications and satellite technology. Most Americans who are not involved with advanced technology do not understand what is possible in terms of insider trading and financial fraud with intelligence and surveillance tools like PROMIS and Echelon. The hardest part to understand for most people is that by taking care of our own business, being honest, paying our taxes, trusting in the system, believing a false media, and avoiding the hard questions, we have played the patsy—even been the beneficiary of and complicit in this worldwide organization.

DA: This is very disturbing and sad. Especially because of how many people throughout the country got burned by the Enron collapse. But I know from talking to you, that even after seven very tough years of DOJ hassles, you remain very positive, and that you feel you have found a way to surmount these problems. Solari, Inc, your investment advisory firm is really your answer to all of this. Perhaps, to sum up our discussion, could you explain how the Solari concept might help us?

CAF: Enron, the dot.com fraud, the S&L scandals, HUD, BCCI—these financial frauds are symptoms of a deeper problem. In the Old Testament in the Bible, there is a passage that says essentially, we have to take care of the land, we have to take care of each other and we have to take care of ourselves. What folks mean when they say that we have a “nonsustainable economy” is that we are not taking care of the land, we are not taking care of each other and we are not taking care of ourselves. It’s that simple. Another way to describe it is that we are destroying our natural resources and environment and stealing from taxpayers to support corporate growth and wealth in a manner that is increasingly wasteful—it shrinks the pie. At the heart of the matter is the fact that the current corporate and bank model has a negative return on investment and so does the American economy. We have kept the game going by persuading the rest of the world to shift to dollars as their reserve currency and to finance our continued and ever-growing borrowing. This necessitates coercion and more and more of it. I suspect that much of our foreign policy in Latin America, the Middle East and Eurasia is not just the importance of controlling global oil reserves as the production curves peak, but to ensure that oil and other key markets are traded in dollars. If the Middle East were to shift to trading oil in the Euro, America would be in quite a pickle. Ultimately we will have to confront the inevitable. Rather than satisfying our “habit” for more capital consumption, we will be forced to reengineer our fundamental economy to a much higher level of productivity.

So what do we do? Essentially, we have to reengineer our economy from a negative return on investment to a positive return on investment. At the heart of that is reengineering government investment, credit and regulation by place.

ENDNOTES:

18 New York Times, “Lawyer Proves a Thorn for Enron Partners,” David Barboza, Sept. 21, 2002

19 THE BCCI AFFAIR EXECUTIVE SUMMARY

***********************

In the final part of this series, Part Seven, we conclude by examining in more detail what we all can do to help the financial system get out of the black hole that is now synonymous with Enron.

(Click Here for Part Seven)

***********************

Catherine Austin Fitts is the President of Solari, Inc. ( http://solari.com) and a former Assistant Secretary of Housing – Federal Housing Commissioner in Bush I. She is currently litigating with Ervin and Associates (acting on behalf of the government ) and the Department of Housing and Urban Development. If you would like to support her litigation efforts, you can through Affero/ Venture Collective: http://www.solari.com/vote.php

If this “Mapping the Real Deal” was useful for you, you can leave comments and send a gift to Catherine Austin Fitts and Scoop Media through Affer: http://svcs.affero.net/rm.php?skid=sp0

and receive future columns for free by e-mail – see… Free My Scoop to sign up.

©opyright Daniel Armstrong, March 2003