“For now we see through a glass, darkly…”

~ Corinthians 13:12

By Catherine Austin Fitts

I don’t remember a week in which I have had more conversations about the value and the future of the US dollar.

The US equity markets have risen significantly since their 2009 low. The divergence of yields and price-earnings ratios of equities in the US markets relative to those in the emerging markets signals an opportunity as the emerging markets perk up. Yet, if we get a significant rise in the dollar this summer, better to wait and shift then. Hence, investors eyeing the opportunity to arbitrage the divergence in values between G7 and G20 stock markets ponder the dollar.

To continue reading Catherine’s commentary on current events subscribe to The Solari Report here. Subscribers can log in to finish reading here.

There are analysts who are adamant that the dollar is about to collapse. I spoke with one Internet radio host on Friday. His website is ripe with interviews predicting collapse of the dollar, or a catastrophic collapse of the US economy or both. It is quite terrifying to do a scan of the headlines – all representing a remarkable consensus that the dollar is toast and soon.

I took a contrary view, saying I thought such scenarios during 2014 were unlikely – believing that the ongoing debasement I refer to as the “Slow Burn” can continue for some time. This is explained in the Solari Report Annual Wrap Up as well as our quarterly Wrap Ups. Our position is that a greater risk is the covert or overt wars that may result from a global economy in recession, even contraction in real terms, as currency wars and competition for natural resources continue. Investors additional risk is not organizing their investment of time and money to outwit the slow burn which is indeed collapsing many local economies as well as automation and globalization which is collapsing incomes in many areas in the developed world.

I also said that it was critical to talk about how people respond to possible futures. In my experience, a bombardment of terrorizing scenarios delivered with high confidence causes people to disinvest in themselves and their future. Better to have a conversation about how to build wealth and protect yourself in a slow burn, than worrying about worst cases where our personal chances of survival are small. I then offered to bet him $1 dollar that the US dollar would not collapse by January 1, 2015. A competitive fellow, he offered to bet me a dollar that the US dollar index would be below 80. Below 80? Doesn’t sound like someone confident of a dollar meltdown.

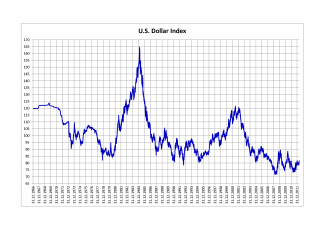

Below are two charts – the US dollar index from 1966 to 2011 and then from 2003/4 to date. From 1966 to 2006, the long term trend was steadily sloping down with some pronounced run ups during the period.

However, since 2006 we have been essentially trading side ways, with 80 being a critical line at the center of the sideways movement.

If you look at the position of the G-7 banks managing the global currency system, for now they have the upper hand. If you look at who controls the hardware that the payment, settlement and communications systems operate on, whether cables under the ocean or satellites in the sky, and the weaponry to enforce, the G-7, particularly the US, command the global infrastructure to operate the global reserve currency. The BRICS do not – not to say they cannot and will not continue to build more robust trade and settlement arrangements that continue to diminish the US dollar market share. It is falling steadily as part of the rebalancing of the global economy.

However, the global currency systems are indeed wearing thin. The signs of tension and currency wars are everywhere. And that raises some profound questions about what is going on behind the scenes. We have been watching a systematic effort to get all countries globally “in the central banking club.” In part this explains the pressure on outliers such as North Korea and Iran. Once everyone moves inside the system, a reengineering of the global currency and settlements systems will accelerate. Watch the pronouncements of IMF head Christine Lagarde – she continues to run trail balloons, all of which just seem to increase fears of increased taxes, capital controls and bank bail-ins.

The drum beats on climate change continue in an effort to move towards greater regulatory top down control and global taxation. Please beware the latest efforts by the EPA and the US Administration. Most of all, beware the calls for changes to the constitution on the part of members of Congress. Campaign donations is the “can opener” issue – the worms that will flow out of the can will be most frightening and include some that will facilitate reengineering the US currency and fiscal commitments.

Meantime, the covert violence increases – whether soft weapons, weather warfare, cyber-hacking, or sanctions. We try to use our digital systems and our financial markets to trade, transact and communicate. However, we are operating on platforms and living in a natural world all of which have become weapons of war. This news tonight is that Turkey has cut off the flow of water on the Euphrates to Syria and Iraq. Egypt is trying to cut off local access to Social Media – keep noticing the relationship between local rioting and efforts to cut off social media.

This means, of course, that anything can happen. However, there is an enormous amount of money sloshing about the global economy and very few liquid markets that can handle it all. For the last decade, when markets get concerned about slowing growth in China or threats to the EU from elections or instability of any kind, they have run to the dollar.

The goldbugs are adamant – the dollar is collapsing and gold is going to the moon. Except when you watch the charts, the price of gold continues to fall lower as the weakest time of the year for precious metal prices approaches and the US Dollar Index continues to hover around and above the 80 technical support line.

I am adamant about one thing. We have just lived through a financial coup d’etat in the United States and the G-7. I estimate $40+ trillion has been moved out of sovereign governments and pension and retirement systems in the US alone. The unanswered questions abound: Who engineered this? Why did they do it? Where are they reinvesting the $40+ trillion and their other accumulated capital? Who has what suppressed technology and advanced weaponry?

At this point we have too much financial and military power along with surpressed technology which has disappeared behind black budgets and shadow financial systems and supra legal systems – I refer to this system as the breakaway civilization – to see what is happening clearly. Does the breakaway civilization want the US dollar to remain the world reserve currency? Or would they rather reconfigure into a new global system that allows them to put the final squeeze on the American population, blaming global forces? The absence of hard information is frustrating – which is in no small part the inspiration for a remarkable gathering of serious researchers to address these issues at the Secret Space Program conference in the San Francisco Bay Area at the end of June.

We do not have the basic information we need to make a fundamental analysis. Instead, we see through a glass, darkly, and watch the US Dollar Index and the price of gold like a hawk.

Related Reading:

Google is Building 180 Satellites to Spread Internet Access Worldwide