“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.”

– Alan Greenspan

Throughout history, empire builders have struggled to develop mechanisms to expand and maintain control of territory and people. Their intention was not simply to invade and to occupy, but to do so economically. An empire must be grown and governed in a manner that is financially feasible; otherwise it shrinks, implodes or is lost to others.

I. Theme: Planet Debt

- Challenges for the Imperialist

- Debt and the Databeast

- Financial Coup d’Etat

- Global and Domestic Blowback

- Harvesting Human Resources

- Mandating Markets for Monopolists

Challenges for the Imperialist

How do you invade a population in a manner that elicits little or no effective resistance? Once seized, how do you manage and harvest the human and natural resources to ensure that the acquisition is profitable? How do you persuade the local population to support your harvesting for minimal enforcement costs? And how will you maintain momentum and growth? The more you seek to acquire new territories, the greater the risk that others will see you coming and organize against you, thus increasing your costs and risk of acquisition.

This is akin to the challenges faced by real estate developers as they attempt to consolidate a large amount of land with multiple owners. The goal is to operate under the radar in order to suppress prices and to reduce resistance while trying to get the “whole enchilada.”

If history has taught us any lesson, it is that utilizing standing armies to achieve one’s objectives via force can be very expensive. In contrast, ensnaring populations with legal and financial mechanisms which serve the empire and which are enforced by the local aristocracy is preferable: it is more efficient and less costly.

The use of debt and financial arrangements is a more efficient way to project power and to centralize control rather than doing so with visible force and standing armies.

The Holy Roman Empire

As the Roman Empire matured, it brought its armies back to center and left the Holy Roman Church in place to manage its interests. The Church, functioning as both an intelligence and investment network, provided a much more strategic and economical tool for managing an empire than standing armies. For the Church, two thousand years of tax-free returns and diplomatic immunity supported by what is now one billion members who confessed weekly (creating what was, until recently, the ultimate control file and intelligence network) along with paying a 10% tithe for the privilege, has proven to be one of the most powerful investment models the world has ever known.

In modern times, this model has been emulated in novel ways.

The British Empire

The rise of the British Empire depended on the control of global sea lanes combined with superior intelligence networks and the ability to deliver covert and overt violence efficiently. Ultimately, to out-compete the Chinese dynasty (which some historians believe had bankrupted the Roman Empire and was poised to do the same to England) the British fought back with opium. From the Opium Wars forward, drug trafficking and addiction became a critical component of profitable empire building.

Managing target populations is one issue. But, another aspect of economic empire building is managing a home base population and the constituencies that will run the empire’s business and operations.

The development of central banks, the banking system and the bond market significantly enhanced the British and European model. Financing wars with debt as opposed to a pay-as-you-go model meant that the home-base population would experience financial benefits of war before any bills came due. This was an important point, as a population must provide its own soldiers, many of which will be maimed and killed (although drones, robotics, and cloning may eventually change this). If military efforts are successful, war debts can be paid off through the economic dividends of conquest. Successful conquest then becomes a form of leveraged buyout. But, the cost to the home-base population can be unacceptably burdensome if the harvesting is suboptimal.

The Anglo-American Alliance

As a result of the Bretton Woods Agreement near the end of the WWII, America emerged with the US dollar as the world’s reserve currency and its military as the primary “enforcer.” America’s natural resources and population provided the capacity to assume the costs of maintaining a global empire.

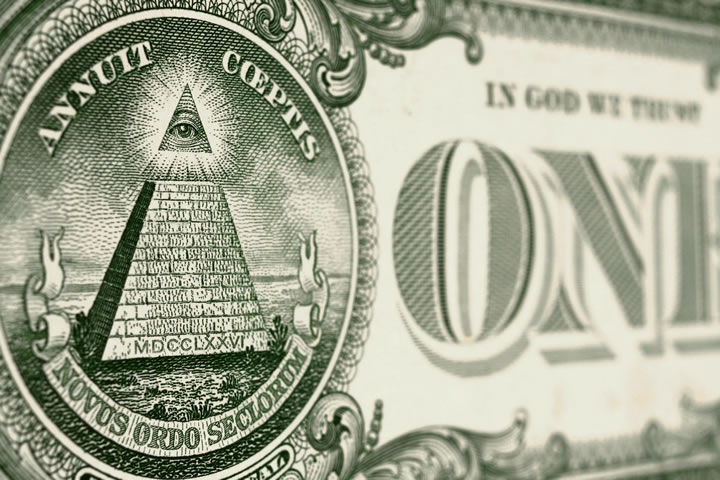

The Anglo-American alliance continued to depend on the central banking-warfare model developed by the Europeans. In this model, a central bank manufactures debt to create liquidity and military forces ensure that debt in the form of currency, notes and bonds is accepted in exchange for valuable natural resources.

The Americans financed their growing global presence with a number of tactics designed to rapidly accumulate significant pools of capital:

- They created a hidden system of finance with gold and other assets that were seized at the end of the war and opened their markets to global narcotics trafficking. This permitted the financing of unaccountable global covert operations and assets, including the development of powerful technology and weaponry.

- They instituted a network of pension and government retirement plans through which the American people channeled significant savings via government and institutional control to finance the rise of multinational corporations. These corporations assumed ownership of global assets and operations.

- In 1971, President Nixon cancelled the convertibility of the US dollar into gold, thus creating a fiat currency with no intrinsic value, which could be exchanged for goods and services globally. With this move, the United States created the capacity to issue a near infinite amount of debt, as interest and principal could always be paid off with money created out of thin air.

The systematic harvesting of countries around the globe has been ongoing since WWII, whether by encouraging nations to issue debt (particularly dollar denominated debt) or to accept US currency and to buy US debt. It is not surprising that some of the largest purchasers of US Treasury securities are nations with a significant US military presence.

Another efficient method of building out a global empire is to replace local leaders with puppets who facilitate centralized political and economic control while maintaining the appearance of national sovereignty. Economic hit men move in to reengineer a local economy and to entrap it in debt. This generates more ownership and cheap natural resources as well as construction and engineering contracts for preferred corporate and investment players. Countries soon find themselves saddled with significant debt and financially dependent on the central empire. If the leadership objects, assassinations or political opposition ensure that new puppets take the helm. Debt is no longer a financial transaction – it is a tool to control and harvest.

Debt and the Databeast

This brings us to the extraordinary technological developments in recent decades with digital computing, telecommunications systems, and satellites in the suborbital platform. These technologies have created global surveillance and intelligence systems as well as financial transaction and payment systems; these can be managed with artificial intelligence to apply the economic hit man model not only at a national level but also at the community and individual level. These systems operate on a highly economic basis.

With software and databases doing all the work, running a “hit” on households earning $35,000 a year can generate quite a profit: origination fees and interest on credit cards, subprime mortgages, student loans, bounced check and late fees. Best of all, debt relief ensures that young people will join the military or go to work for large corporations: debt can be a persuasive recruiting mechanism.

This means that invisible, economic warfare is now a profitable business when applied to the harvesting of individuals on scale. The firepower designed to force countries into submission can now be applied to each man, woman and child in the system on a granular, real-time basis.

During the past thirty years, Americans have experienced increasing dependence on computers with operating system trap doors, phones scanned by US intelligence and enforcement agencies and extraordinary data-collection and integration by private corporations paid with US tax dollars. The result is not only a “one way mirror” as described by Edward Snowden and Glen Greenwald (and by NSA whistleblowers William Binney and Tom Drake), but also a delivery mechanism for entrainment technology and subliminal programing (see Entrainment, Subliminal Programming and Financial Manipulation). The system is both a one-way mirror providing rich surveillance and economic intelligence and one-way mind control impacting the recipient’s allocation of time, resources and decision-making.

The genius of such a system can be seen when comparing it to the Holy Roman Church. Digital information systems can compile control files much faster than church confessionals. They also extract more than a 10% tithe while delivering mind control without the cost of maintaining a “store front” presence. It is not surprising that the Catholic Church was saddled with sole responsibility for the pedophilia scandals. They were bested by the application of digital technology to create a new, more efficient control model.

Instituting zero-integrity information systems has not been without resistance – it has required the targeting, financial and legal destruction or assassination of countless government and business leaders and citizens who have opposed the unlawful violation of individual and organizational privacy and sovereignty.

Not surprisingly, the successful integration of these systems has coincided with increased government and central bank intervention in financial markets and the increased centralization of wealth and political power.

What has evolved is the ultimate financial entrapment operation in which one set of players:

- Creates fiat money and lends at zero expense

- Maintains an unlawful information advantage that violates the laws related to material omissions in financial transactions, fraudulent inducement and predatory lending

- Engages in dirty tricks that impact the borrower’s ability to pay

- Legislates laws and regulations which make it profitable to lend to people who fail and cannot pay back their debt principal

Our telecommunications, computing and media systems serve political and financial monopolies, not retail customers. Rather, these systems are part of an integrated financial apparatus, which is designed to harvest the customer.

So much for market economics.

Financial Coup d’Etat

We are witnessing a world divided into a two camps. One camp has the capacity to lend an infinite amount of money and the other is systematically required to 1) serve the first, 2) borrow or 3) be enticed into dependency on government subsidies. Not surprisingly, the government subsidies are financed with debt sold to the second camp’s pension funds or the harvesting of its local economy and natural resources.

We have created the conditions in which debt can entrap an entire planet. The financial coup d’etat and the leveraged buyout of planet earth have continued beyond the 2007-12 bailout period. This is a way to reengineer the global governance system.

Until recently, the US had been moving aggressively to complete the shift of the entire global economy into a G-7 dominated model that began with the end of the Cold War, the adoption of the Uruguay round of GATT and the creation of the World Trade Organization (see Financial Coup d’Etat).

Following the events of September 11, military invasions targeted countries, which had maintained or encouraged financial independence outside the G-7 dominated system. This included consolidating control over Middle Eastern oil supplies. Bailouts enriched the G-7 establishment and large lending institutions. New legislation extended US jurisdiction and enforcement powers over global banks and financial institutions. And this legislation required transparency of global financial flows to US intelligence and enforcement agencies.

Global and Domestic Blowback

Then a series of NSA whistleblowers culminating in Edward Snowden enabled both US allies and targets to appreciate the extent to which the Americans had compromised global telecommunications, the Internet and computing systems. This inspired pushback as foreign governments sought to preserve information and financial sovereignty as prerequisites to maintaining national sovereignty and wealth.

Russia and Brazil announced steps to create their own Internet and payment systems. Following information sovereignty, however, the next step was to improve financial sovereignty outside the dollar and US system. Russia and China announced plans for a new rating agency. Numerous BRIC nations announced currency swaps to facilitate direct trade and settlement. China organized the Asian Infrastructure Investment Bank (after announcing they would not reserve a veto) and attracted numerous European nations as members. Frustrated by the delay in restructuring the IMF, many European members joined the AIIB in March of 2015 over the strong objection of the United States.

It appears that Mr. Global did not want to depend solely on the United States to build out the global financial system. The Hegelian dialect is at play: the BRICS are building out a Plan B.

The United States’ global effort has stalled in more ways than one. For several years, American agreements – the Trans-Pacific Partnership, the European Trade Alliance, and the restructuring of the IMF – have been mired in Congress as politicians dealt with constituents’ objections to the cost of foreign wars and a shrinking middle class. This is a reaction to the centralized engineering of falling incomes, the pump-and-dump of the housing market and various forms of debt entrapment.

Now that taxes have been paid on April 15th, there is a new push to fast track the TPP. Let’s see what happens.

Harvesting Human Resources

The greatest broadside of the American people, however, is just beginning. Two of the most significant economic activities in the 3100 counties (local economies) that make up America are health care and education. Not coincidentally, health care practitioners and teachers represent the two most important aspects of what remains of US middle class “backbone.”

Federal mandates are requiring that health care records be digitized while the Affordable Housing Act is essentially forcing health care financial flows into corporate hands.

Digitization of records and standardization of treatment will permit more than a trillion dollars in labor costs to be squeezed out of the health care sector. This has produced quite a windfall for equities as health care has lead the US stock market to outperform global markets for several years (see Stock Profits of Obamacare).

The same process is underway with the mandating of the common core curriculum and standardized testing in grades K-12. This begins the reengineering of the education process and will significantly reduce the need for and the authority of teachers.

Federally mandated reforms, if successful, will permit corporations to assume profitable ownership and control of a much greater portion of the education system: everything from software and online systems to the construction and management of charters schools. If federal legislation mandates vouchers that carry an obligation to use federally regulated curriculum, corporate involvement will likely explode.

Classrooms and online systems will soon provide direct access to children by large corporations and intelligence agencies. With the ability to integrate these flows with those coming from health care records and financial systems, the real harvesting begins.

Mandating Markets for Monopolists

For the oligarchs, the beauty of this system is that local taxpayers will pay to educate a small work force trained to run their monopolies while marginalizing the rest of the children. The oligarchs would certainly not want these children to become entrepreneurs who start business that threaten those monopolies!

When you look at the potential that the reengineering of health care and education systems has to create monopoly profits – both income and stock market value – you can appreciate why the US leadership wanted the general population over a financial barrel. Whether deeply in debt or financially dependent on government subsidies (which are financed by debt sold to their pension funds), we are witnessing another form of leveraged buyout.

The American people have often been successful in resisting the overreach of leadership when the health and safety of their children are involved. Gun control, mandated vaccines, fresh food, home schooling: these have all represented political failures for those attempting to control centrally.

Hence, it will be interesting to see whether the push for information and financial sovereignty by the BRICS will connect with the domestic pushback by the remnants of the American middle class. This group includes the health care practitioners and teachers whose income will be reengineered away by corporations seeking profitable access to the minds, spirits and bodies of children…without the intervening supervision of teachers and doctors.

Perhaps a successful political effort will be aided by the realization that federal mandates of the US health care and education systems are really one organized plan. This plan will privatize a large share of the US economy into private monopolies funded by taxpayer mandates.

Once again, so much for market economics. Perhaps this is why so many oligarchs finance academic and think tank books, articles and lectures suggesting that our problems are the result of “market forces.”

Ultimately, this means that the politics of debt within the US have the potential to connect with the politics of debt outside the US. Domestically or globally, debt has been used by the US and the G-7 leadership to consolidate global control and to compromise national and individual sovereignty. That leadership has been able to implement their will simply by issuing more currency and debt and by throwing more money at the problem.

However, they are now running into informed opposition: people who reject their model at any price. In combination, their enemies and opposition have significant political clout and – among the nation states – powerful weaponry.

Resources

It is not surprising that the US is moving to negotiate deals with Iran and Cuba. The US leadership is facing too many open flanks and enemies all at once.

The ongoing question for the Solari Report is, what is the endgame of exploding debt levels and what can you and I do about it? We will be engaging in this conversation with you on an ongoing basis.

In anticipation of that conversation, let’s review the current state of global debt.

12 Things You Need to Know About Global Debt

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

~ James Carville

I. Global Debt Nearly Doubled Between 2007-2014

From the statistics we have, global debt has almost doubled since 2007:

Global bailouts have helped financial institutions improve their financial condition at the cost of governments and households.

We now have over 39 countries with Debt/GDP ratios of more than 100%:

Whereas before the bailouts, the developed world was highly leveraged, now it is both the developed and developing economies. Developing countries have significantly increased their debt loads during this period.

II. Accessible Statistics on Debt are Insufficient to See Our Situation Clearly

The available information on global debt is spotty. Statistics on who issues debt (that is, borrows) are easier to locate than statistics on who lends (that is, is the creditor).

Official data on global sovereign debt issued by government borrowers is accessible. However, at least in the case of US sovereign debt, we know that the numbers are not reliable and that outstanding debt may be significantly higher than reported. There is less information on debt issued by corporations, small businesses and households.

There is significantly less data available on debt as a financial asset – both who owns it and who calls the shots related to decisions and control issues. This information is essential as debt at such high levels functions as a governance system for creditors who control from behind the scenes. Debt is an important mechanism with respect to covert funds, which flow into the overt economy – often with invisible strings attached.

There is also insufficient information regarding assets that have been financed with debt. As an example, governments may issue debt and use the proceeds to fund secret projects, technologies or advanced weaponry. This debt appears on government balance sheets, but the assets are not recorded on the balance sheet. In some cases, they may have been reverse-engineered into the hands of private companies or investors.

III. Global Debt is an Essential Component of the Central Banking Warfare Model

When reviewing debt statistics, it is essential to appreciate the relationship of debt and its issuer to the currency in which the debt is denominated.

If the US issues debt denominated in dollars, which it can repay by simply printing dollars, there is little risk of default. If Mexico, however, borrows Euros it must earn Euros to repay the debt. The first instance involves a promise to print currency, which the issuer controls. The second instance is an actual debt which requires borrowers to deliver a currency that is not in the debtor’s control. That country must earn those Euros because they can’t be printed out of thin air.

Consequently, it is not surprising that size of global military spending is a meaningful portion of the amount of global debt issued. The larger a country’s military, the greater its capacity to create currency and to sell debt in the currency it creates.

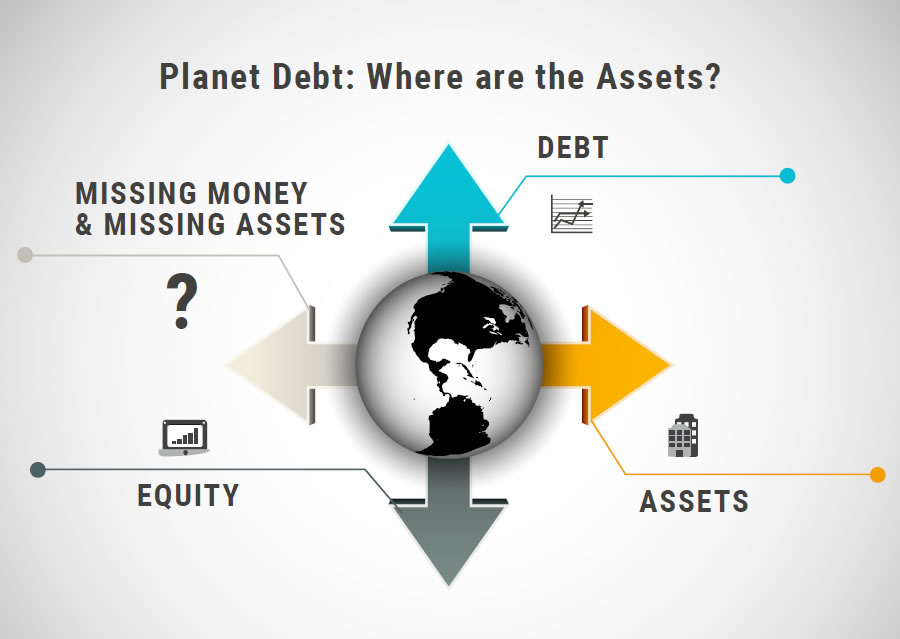

IV. Understanding the Economy Requires Financial Statements Which Integrate Covert Cash Flows and Assets

There is an enormous “black hole” on the planetary balance sheet:

- Government debt is issued

- Sometimes this debt is recorded on government balance sheets, sometimes it is not recorded

- In some cases, the assets which are financed by this debt completely disappear from the planetary balance sheet

We can document this missing money, but we can only guess as to where it went.

Is debt as a % of GNP growing? Or are certain assets and portions of the GNP missing from the official financial statements? An accurate picture of our financial situation requires integration of both overt and covert financial statements. At this time, we do not have such a picture.

Perhaps the global population has been encouraged to spend beyond their means so that they do not ask “sensitive” questions. In essence, debt used to finance government spending can buy cooperation.

This is one of the reasons why transparency regarding missing money and assets will be critical to finding solutions to government deficits and growing debt.

V. Invasive Digital Systems Have Fundamentally Altered the Nature and Economics of Debt

This insight is a new one – and it’s important.

A significant development occurred in the 1980’s and 1990’s: American cable, internet, software, and telecommunications companies created and built out what Glen Greenwald referred to in his interviews with Edward Snowden as “a one way mirror.”

US corporations and intelligence agencies were then able to integrate these systems with the application of entrainment technology, subliminal programming, artificial intelligence and relational database marketing. This created the capacity to apply “economic hits” on a much more granular level. It was now possible to target households and individuals on a highly economic basis.

This is how it works:

A financial institution originates a mortgage for a family of four which they sell to Fannie Mae after collecting the origination fee (the institution is not liable on the mortgage). The father works at a local manufacturer that the financial institution knows will be moving to Mexico soon (they are financing the transition) and they anticipate that the father will lose his job. But they don’t inform him, hence committing a material omission in the transaction.

Twenty-four hours after losing his job, the father’s credit card interest rate is raised to 30%. One of his children becomes ill and the father must use his credit card to pay these expenses (the family lost its medical coverage after he lost his job).

The father pays the 30% interest rate on the medical expenses and eventually falls behind on his mortgage payments. At this point, unemployment compensation and food stamps are the family’s sole source of income. These are insufficient to cover the family’s overhead despite significant reductions in spending.

Mysteriously, a local marijuana dealer is inspired to pay the father a visit – a marketing call of sorts. The father begins to smoke again in order to handle stress. One night while he is getting high, an associate of the drug dealer steals his car. Insurance covers most of the cost, but insurance premiums go up. Because the father’s credit score has fallen from 800 to a very low one, he doesn’t qualify for an auto loan. So he buys a used car which is financed at a predatory rate.

Desperate, the family sells their home for equity to pay living expenses. The financial institution originates another loan and (once again) sells it to Fannie Mae. The auto loan and the Fannie Mae pools are securitized and sold to a fund held in the father’s IRA…before he liquidates it to help pay his mortgage and auto loan.

When Fannie Mae goes bust in 2008, taxpayers (including this family) are called upon to finance its bailout.

When a banker at the financial institution suddenly warns about the compromise of client financial data and predatory practices, she is murdered on the path where she jogs each morning.

In a short period of time, the family goes from being a successful, middle class family with savings to a family that has been profitably harvested by the financial system.

What the father and those around him cannot fathom is that the financial institution, the credit card company, the marijuana dealer, the car thief, the car dealer and the insurance company were all drawing from what was essentially one relational database operation designed to profitably harvest people in locations.

The banker who could fathom this and who wanted to do something about it is dead.

Via televisions, computers, smart phones and smart meters, American households have provided access to intimate personal and financial data to syndicates of intelligence agencies and large corporations. And this information is being integrated with a vast array of what is supposedly confidential data and funneled to government and financial institutions to be used in predatory ways.

What this “one way mirror” has built is a mechanism that allows the “economic hit man” game, which once operated at a county level to be applied at the household and individual level. The result has been an explosion in outstanding debt because the institutions that create currencies find it highly economic to loan money that can never be paid back. These loans may appear to be un-economic, however this is not the case when the ancillary profits of controlling and liquidating the target are integrated into the economic picture. This includes the control of local government political positions and financial flows and assets.

In essence, creditors can make money from engineering the failure of those to whom they lend.

VI. Consolidating the Global Economy Necessitated That the War on Terror Target Financial Institutions and Islam

Enforcement of War on Terror laws, regulations and administrative policies has been instrumental in expanding US jurisdiction over global banking and wealth management.

Islam is the fastest growing religion in the world – particularly in Eurasia where the growing trade between Asia and Europe threatens American global hegemony.

Prior to the War on Terror, significant financial flows in the Islamic world were invisible to Western financial institutions and intelligence agencies. In addition, Islamic principles reject bank interest, particularly usurious levels of interest.

Islam had to be brought into the West’s central banking warfare model.

VII. Digital Systems & Revisions of Usury, Bankruptcy and Student Loan Laws Made it Possible for the US To Create and Maintain an Enormous Divergence in the Cost of Capital Between Preferred Players and the Average Person

Since the mid-1990’s, we have seen a remarkable divergence in the cost of capital to various sectors of the economy which cannot be explained by credit strength or market forces of any kind. This divergence has been engineered with numerous efforts to prevent local and alternative forms of currency, access to financial data, and liquidity of local equity.

For example, in the late 1990’s, hedge funds were borrowing on the yen carry trade at 0% while small businesses were paying 15-30% interest rates, were not allowed to issue local currency, or (as a practical matter) were prevented from raising equity with securities. Another example is Senator Elizabeth Warren’s description of borrowing costs on federal education loans relative to bank’s borrowing rates at the Fed window.

This divergence is one of the critical components of engineering the slow burn.

VIII: The National Security States Integration of Invasive Digital Systems Has Expanded the Use of Debt as a Weapon of Economic Warfare and Financial Coup d’Etat

There are important relationships between the debt system and other tools of economic warfare, including market interventions (quantitative easing, suppression of the gold price), financial sanctions, expansion of global regulatory authority and cyber-warfare. The goal of many of these actions is to ensure that players cannot create liquidity outside the control system.

IX. The Growth of Debt as an Entrapment System Since WWII Has Inspired Significant and Growing Blowback

The bailout period from 2008-2012, as well as subsequent quantitative easing, has contributed to a growing appreciation that the dominant debt system is a control system: there is no privacy – there are no markets. Along with high debt levels and a growing understanding of the “one way mirror,” this is contributing to the creation of alternative systems outside the G-7 and the slowing of the global economy.

It would appear that the Hegelian dialectic is at work: Mr. Global is permitting a Plan B. Another way to say this is that the Americans are now facing a much more informed global audience and growing economic competition.

X. Global Debt: Who Controls?

High debt loads managed behind a one-way mirror represent a critical component of governance systems. Which brings us to the question, who controls? How much centralization and consolidation of power has the debt system facilitated (clearly a great deal) and into whose hands?

Is our global debt system open or closed? The answer to who controls ownership of debt (whether as investor or agent) and how this relates to our current governance arrangements has powerful implications for the evolution of civilization.

XI. Houston, We Have a Problem!

My thesis is that debt in the United States is being used to affect a financial coup’ d’etat.

Populations have been targeted with predatory lending and financial entrapment along with other tools of economic warfare. As a result, a significant number of people now have minimal assets or savings and they are highly dependent on large banks, government subsidies and government jobs.

This situation permits leadership to further implement invasions of privacy and a reengineering of the financial system to corporate control. This includes mandating a much greater penetration of health care and education by digital systems, making it possible to reengineer and privatize a sizeable portion of these sectors. In addition, large corporations and intelligence agencies will be given direct access to children’s health care and education in a manner which can only be described … as terrifying.

XII. Global Debt: What is the End Game?

The answer is: we don’t know.

This will be an ongoing conversation on the Solari Report as we attempt to understand where the continued growth of debt will take us, what it means to you and me, and what we should do about it.

My Expectations of the General Direction in Which Planet Debt is Taking Us:

- Reengineering global governance: Expect to see further centralization of currencies and the implementation of digital currencies.

- Increased “piratization”: “Piratization” is my word for privatization at prices that are not at market levels. High debt loads will be used to insist that countries and municipalities privatize valuable assets and operations, often at below market values and terms and conditions. This will support continued growth in the number of large corporations and their earnings and assets.

- Abrogation or re-negotiation of retirement benefits and pension obligations in the developed world; pressure to direct pension fund assets to serve centralized interests.

- Increased global activity on large infrastructure projects.

- Increased military expenditures by the developing world.

- Continued high levels of global indebtedness for some time to come.

- Continued growth in the size of global equity markets. An effort will be made to “crash up” the global equity markets in a manner that attracts the emerging middle class in developing countries to participate in the stock market broadly.

- Continued inquiry as to where missing assets and money are disappearing and whether or not the debt system on planet earth is open or closed.

The greatest risk to you and to those you know is the use of debt, which would compromise one’s individual sovereignty. Consequently, it is advisable that we understand that personal debts should be sound financial transactions with lenders who operate lawfully. We need to be able to avoid situations where debt is a vehicle for entrapment or economic warfare by the syndicates which certain lenders serve.

News Stories & Trends

As with our 2014 Annual Wrap-Up, the top stories in Q1 2015 follow the trends that drove events during 2014 and will be doing so for years to come. These are not the stories that got the most attention – but they got our attention.

Planet Equity

Global stock markets continued to grow in the first quarter of 2015 with European and Asian stock markets beginning to close their divergence with the US market.

The Oil Card: The East-West Pendulum

Rebalancing the global economy in the first quarter turned into a story of US “blowback.”

- That Chinese Development Bank Thing

- What’s Up With Oil and Gas Prices?

- Obama Scrambles for TPP Deal

- Isis Ransacking of Ancient Assyrian City Confirmed by Iraq’s Head of Antiquities

- The Geopolitics of Finance Heats Up: Russia and China Launching New Credit Agency

- The Whacking of Fracking

Global 3.0 Rises

It’s 3 months later and we still don’t understrand what the CERN Hadron collider is all about. We do know what Etsy’s about…but a $1.78 Billion valuation??? Who knew arts and crafts were this hot?

- CERN Hadron Collider Restarts After Two-Year Upgrade

- Etsy Seeks Up to $1.78 Billion Value as Artisan Site Readies IPO

Global 2.0 Struggles

With the G7 and Bilderberger meetings in Europe in June and the Bohemian Grove meeting in San Francisco in July, US leadership is falling over itself trying to impress the oligarchs. It’s enough to make you want to go to mars!

- The Hubris Bubble

- The Dead Bankers Scrapbook: Murder-Suicides, Freezing on a Mountain, BNP-Paribas, Central Banks Losing Control?

The Uncivil Society

Who says the American people don’t get it? It looks to me like they do.

The Education Tsunami

If you liked Obamacare, you’re gonna love common core (they are 2 sides of the same coin).

- A Win Against Common Core

- Book Review: The Educator and the Oligarch

- The Targeting of Atlanta Teachers

Emerging the Global Currency

The Russians and Chinese keep moving ahead with Plan B.

- Russia’s Banks Transact MasterCard Operations through National Payment System

- Vladimir Putin Calls for ‘Eurasia’ Currency Union

The 21st Century Move Into Space

The Secret Space Conference videos went viral and the response was fascinating.

- The Secret Space Program: Videos are Now Available to the Public

- Japan Begins National Security Space Buildup

Transhumanism

Since I believe that federal mandates in education will be designed to give corporations and intelligence agencies direct access to children, the transhumanism conversation just got a lot more interesting. The people who want direct access to your kids plan on living forever.

Wicked Problems

From a respected source; but given the implications, this is one we won’t worry about.

The Demographic Derby

It’s possible that the legal profession and the courts will run the risk of choking and drowning on creditor versus beneficiary issues. The solution is to stop fighting and to build wealth.

Food and Water Grow Scarce

The big money just keeps moving into what’s important.

The Infrastructure Opportunity

As China attempts to build up the Yuan globally, one of their techniques is to build high-speed rail lines.