“The bigger the breakdown, the bigger the breakthrough.”

~ Thomas Hupp

by Catherine Austin Fitts

Our theme in 2014 is Break Away.

Deep, significant shifts in investment and credit flows are like a shift in the water table and the rivers and streams within a place. The change ripples throughout the ecosystem. It changes where things grow and where you build a house. It changes the fundamental economics of many of the businesses and enterprises. It changes the “field” – the energetics around us – and that changes the dynamics of many of our personal and professional relationships.

We are in the midst of an historic pivot of investment and credit. The world is turning. The financial coup d’Etat has come to a close. Trillions have been shifted from the traditional industrial model – let’s call it Global 2.0 – to a networked model organized around digital systems – let’s call it Global 3.0. To give you a sense of the magnitude of the capital flows, our team prepared a chart describing the shift of an estimated $40+ trillion from Global 2.0 to 3.0.

See the 2.0 to 3.0 chart here.

The decisions that have been made to effect the change may be ones we agree or disagree with. Once the dam has been demolished, however, and the water is rushing downstream, it is essential to understand what is happening and determine what that means to us and those we love.

If we are going to break away, we are going to break away towards something. What’s the action? What’s the direction? What are you for?

You have heard regular discussion on the Solari Report about the power of your imagination and the importance of inventing your own world and to contribute to inventing the world around us. These are themes that Jon Rappaport and I focused on in such Solari Reports as The Power of It, Exit the Matrix, and our look at the Singularity. This requires seeing and rejecting the stereotype of your life and your future that others set for you – often without respect and with an intent to advantage themselves or their enterprise.

You have heard regular discussion on the Solari Report about the power of your imagination and the importance of inventing your own world and to contribute to inventing the world around us. These are themes that Jon Rappaport and I focused on in such Solari Reports as The Power of It, Exit the Matrix, and our look at the Singularity. This requires seeing and rejecting the stereotype of your life and your future that others set for you – often without respect and with an intent to advantage themselves or their enterprise.

The capital shifted out of Global 2.0 is now being reinvested in Global 3.0. This means that the creative destruction in the existing economy is accelerating. It also means that anything can happen. When a world fades away, it does not always go quietly. When a new world grows, it can be immature and make terrible mistakes.

Life is unpredictable.

In our Halloween special report on Zombies, I described a scene in World War Z when Brad Pitt tried to persuade a family frozen in fear, hiding in their apartment from the Zombies, to come with him. He explained that in places or times of distress such as these, “movement is life.”

Break Away is about choosing life. You have heard the term Break Away a lot this year on the Solari Report as we talked about the “breakaway civilization.” In one sense, the breakaway civilization’s movement of money and resources out of Global 2.0 creates the urgency of our shift.

But our theme “Break Away” has little to do with aligning or choosing to follow the breakaway civilization — whoever they may be.

Break Away is about facing facts as Global 2.0 grapples with managing more liabilities than assets and loses its fundamental legitimacy in our eyes (its “mandate of heaven”). It’s about being attracted to a vision of our future that represents the world we want to live in and leave to the next generations. It is about letting go of those people or activities who no longer give energy or life to us as we change direction, and embracing those who do. It’s about finding your power to invent your world.

How this plays out in each of our lives is unique to our purpose and practical situation. John Adams once said, “the Revolution was in the hearts and minds of the people.” Breaking away is first and foremost in our hearts and in our minds.

If you have ever spent time on a high-speed bicycle, you know what I mean. You start down the road. You feel a bit stiff. Your body warms up. You pick up the pace. Then suddenly, you feel a surge of energy. You break out. You find your flow. Despite your amazing speed, the exertion is easy. You are on your way.

It is a Break Away.

Our annual wrap-up is designed to inform your map of where we have been and the trends ahead. It is designed to help you access a rich archive of excellent Solari Reports to help you see the landscape. While the uncertainty before us is unprecedented, a good framework to organize dynamics and variables can help you to navigate.

I sent ally and friend Thomas Hupp a copy of our poster for 2014. He e-mailed me and said, “Happy New Year! I got the image of the bikers…Is it all the good guys blazing through the tapeworm?”

Indeed, indeed!

The Slow Burn Wins Again

The US Federal Reserve continued Quanitative Easing (QE) throughout 2013, buying up and – I believe – shredding the fraudulent mortgage and Treasury securities still outstanding after $27 trillion of bailouts. With the bank balance sheets cleaned of the fraudulent paper which financed the financial coup d’etat, the trail went cold. Mr. Global declared a quiet success.

I estimate that more than $40 trillion was shifted out of US government entities, pension funds and households between 1995 and 2008 – much of it by illegal means. That amount is in addition to what has been shifted out through the Black Budget and the Exchange Stabilization Fund in terms of technology, financial resources and leverage between 1947-1995.

This is the funding for what Richard Dolan and Dr. Joseph Farrell refer to as the “breakaway civilization.”

Indeed, the amount of money that has been shifted out is sufficient, in theory, to create an endowment that can generate dividends and interest sufficient to finance a US or global government on a private basis. Five percent current income on $40 trillion a year = $2 trillion.

Throughout the alternative media, financial commentators have been assessing the remaining shortfall of assets in pension funds and government entities when compared to their debt and retirement obligations. We are told that we are bankrupt – that things are about to collapse.

That is not the case. The systems that are obligated to pay retirement benefits and health care have shortfalls – some significant and some not, but the hype continues to say they are.

Related Solari Reports

Related Articles & Blog Posts

That puts Mr. Global, the winner of the financial coup, in a control position. A dollar’s worth of promises is competing for 60 cents of assets – and everyone has to suck up to Mr. Global in the process of winning some or all of that 60 cents.

Debt is a control system.

The funds shifted out of the old industrial 2.0 which has been centered in the developed world of North America, Europe and Japan – the G-7 – are being reinvested in Global 3.0. This includes the development of domestic oil and gas reserves in North America, the reengineering and renaissance of the North American manufacturing base and the capitalization of a private space industry and network of spaceports throughout North America. It also includes an explosion of new funding and activity in Silicon Valley.

Global 3.0 is booming. Global 2.0 is downshifting as it uses debasement and debt to continue to slowly deflate the value of most labor and related health care and retirement benefits. The federal budget and black budget intersect as Mr. Global continues to shift overt and covert assets from 2.0 to 3.0.

In short, we took the assets promised to the baby boomers for their retirement and shifted them out to invest in the emerging markets, in new technology and space. The wealth to be created from abrogating and debasing obligations for reinvestment in higher margin economic activities and rebalancing the global economy is a significant contributor to keeping the economy going and keeping the Anglo-American alliance in a dominant global position.

Think of this as the reengineering of global governance on the “just do it method.”

The money stolen is being reinvested and the high tech work force leading that effort is profiting and spending. A significant portion of the population, however, has been “left behind.” You can see the impact when you compare the performance of the consumer discretionary stocks with the consumer staple stocks this year.

Predictions of collapse or hyperinflation reflect a profound naiveté about the black budget, the covert economy and the train tracks of control that keep the slow burn burning along.

We said in the 2012 Annual Report that the chance that the Slow Burn would continue throughout 2013 was 75%. The reason my prediction was not higher was that significant fraudulent securities were still outstanding and the management of the interest rate swaps issued to keep interest rates down were (and are) still plaguing the financial systems.

Not only did the Slow Burn continue, but it displayed unprecedented strength as the reinvestment in 3.0 kicked in and the leadership enjoyed the reduction of personal and corporate liabilities with Federal settlements and Fed shredding parties, as statue of limitations were reached on trillions of financial fraud. The winners of the financial coup are feeling their oats.

Moving forward, there are significant risks on the horizon, but the forces powering the Slow Burn are stronger than ever. I give the Slow Burn an 80% chance of continuing throughout 2014.

Competition for the Slow Burn Train Tracks Heats Up

How can so few people control so many and do it so invisibly?

There are numerous systems used to control. Military and intelligence power and enforcement has always been core. The nations with navies that controlled the sea lanes, and now the satellite lanes, traditionally controlled and maintained the global reserve currency. Throughout history, the financial system, backed up by military power, has become the dominant control system. It is a more bloodless way to engage in warfare, slavery and to harvest and control.

Increasingly, digital systems have supported a much more high powered and invasive communication system, giving way to more treacherous financial systems. In part it is the role of the satellites in that communications system that is shifting the competition into space.

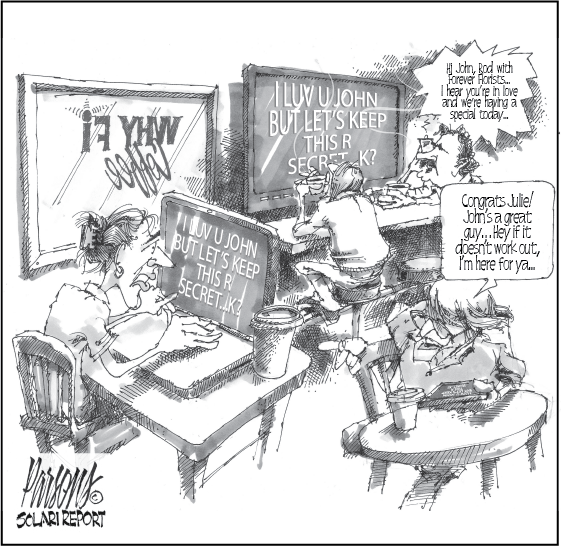

For many years I have referred to invasive digital systems as The Databeast. Having experienced the power of these systems at the most intimate level when applied to surveillance, manipulation and financial fraud in the mortgage markets, I have struggled mightily to warn Solari Report subscribers about the power of computer and communication systems that can listen to hundreds of millions of people and use artificial intelligence to translate that data into high speed, actionable methods of influencing opinion, transacting on inside information, marketing to and exploiting households and managing the political and financial system – of literally making markets. This machinery is at the heart of the slow burn and one of the reasons that Andrew Vachss once referred to the Internet as “the ultimate op.”

Enter Edward Snowden in 2013 whose documentation of invasive surveillance by the NSA of global leaders and citizens and participation in economic warfare has rocked our world – and brought home the reality of a “no privacy” world. This has accelerated plans by numerous governments and private groups throughout the world to begin the balkanization of the Internet – promoting plans for independent satellite and cable systems and new forms of encryption that will allow them to compete successfully in global economic warfare. The reaction was bad news for numerous American cloud and IT providers who suddenly began to ask Congress to roll back numerous Patriot Act provisions. It turns out that freedom may be good for business – at least when people can see what is really going on.

Related Solari Reports

- NSA, Edward Snowden and What It All Really Means

- Internet Freedom: Your Rights in a Digital World

- The Non-Revolution in Digital Payments

- Beware the Smart Grid

The week of April 15 was one of the most painful of the year. Among other things (including a precipitous drop in precious metals prices) a Boston Marathon bombing just happened to lock down the Boston universities and intellectual establishment for several days on the very week that the House of Representative passed the Cyber Intelligence Sharing and Protection Act (CISPA). Leading CISPA activist Aaron Swartz was not available to organize, having been found dead (deemed a suicide) on January 11, 2013 of the year, after a two year persecution by the US Department of Justice. Luckily, the Senate refused to comply and CISPA remains DOA for now. The violence involved in the effort to pass CISPA speaks to the intensity of the forces at work and the importance of this shift of financial flows on to the digital platforms.

At the heart of the competition for control of the Internet is the speed at which the global population is getting on line and accessing the Internet through mobile devices and the network is extending to network things (cars, houses, highways, etc.)

As more and more users integrate into the mobile systems, transaction flows shift out of the traditional banking and credit card systems and onto the Internet and telecom platforms. Sales continue to shift on line. Efforts by Amazon, E-bay and other online stores to implement same day delivery have game changing potential to impact the face of retail in the next year or two. With this shift in flow comes the growth of new mobile payment and digital wallet systems. The competition is still early, and will continue to heat up over the next year.

Where all this goes, off course, is the push for a digital currency, one that makes centralized control even more powerful. Indeed this kind of invisible power is so great, that a great deal of highly economic decentralization can be permitted with the ultimate control tool in place.

The NSA-Snowden revelations have revealed a number of the potential factions for the control and balkanization of the Internet. One interested party is the Vatican, whose traditional network of control files through storefront churches and confessionals has been bested by the NSA-Telecom systems.

Another faction, I suspect, is the IT and Telecom players in 3.0 – both the overt and covert side. Now that the government has directly or indirectly financed the train tracks of the surveillance system, why not squeeze out their power, leaving the private contractors, telecoms, search engines and social media in control? The private players have no reporting requirements to Congress or the American people. The privatization of surveillance will bring on a new round of controls.

The Oil Card Roars Towards a Resilient Model

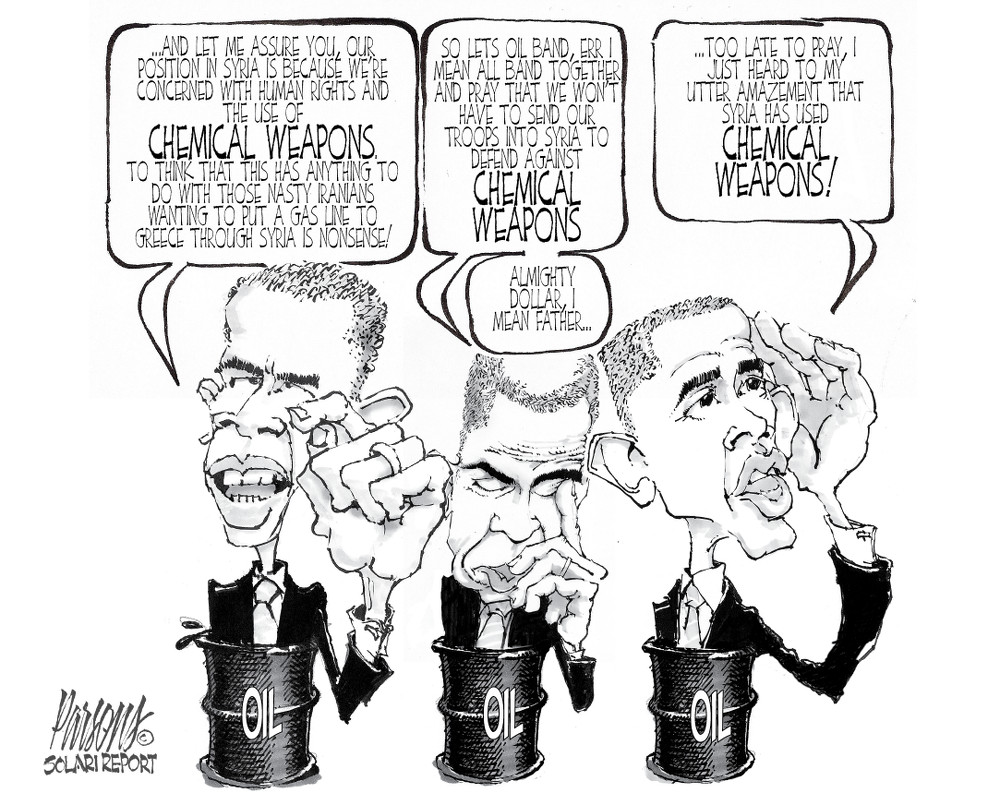

Veteran report Jim Norman has had a lot of airtime on the Solari Report, including his last interview in December 2013. Jim’s framework for the management of oil and gas prices for geopolitical strategic goals goes a long way to explaining what is happening in the global energy markets.

Energy was an important story in 2013. The dollar as reserve currency functions on an oil standard. And, as Jim describes, energy is directly and indirectly 40 to 50% of the cost of manufacturing in North America. Essentially, with machines and automation doing most of the work, energy is a more important component of cost than labor – one that does not organize unions or disagree with management.

Since 2005, America has moved aggressively to develop domestic oil and gas reserves, fueled by the successful development of new, controversial fracking technology and the North Dakota Bakken formation. This has contributed to booming economics in the impacted regions, particularly Texas and North Dakota.

On a net basis, the US is now an energy exporter of refined oil. It continues to benefit from maintaining a global oil price significantly above cost and using its command of the energy industry to assert geopolitical dominance, particularly of China, while enjoying domestic gas prices significantly lower than natural gas prices in Europe and Asia.

On a net basis, the US is now an energy exporter of refined oil. It continues to benefit from maintaining a global oil price significantly above cost and using its command of the energy industry to assert geopolitical dominance, particularly of China, while enjoying domestic gas prices significantly lower than natural gas prices in Europe and Asia.

The growth of domestic reserves is impacting both foreign policy as well as the ability of the US to increase domestic manufacturing, particularly for proprietary and sensitive functions.

Japan’s struggle with its nuclear policy in 2013 was painful to watch. On one hand, their population is reeling from the devastation caused by events in Fukushima and firing up their nuclear infrastructure has significant political repercussions. On the other hand, the cost of keeping the Japanese manufacturing juggernaut going with expensive, imported fossil fuel represents an enormous tax. That cost was very much papered over by Abenomics including aggressive monetary policies that had the Japanese equity markets rising significantly despite the energy squeeze.

The continuing concerns about Fukishima and its impact on the oceans and global radiation levels has not deterred continuing breakthroughs in new, more economic nuclear energy technology.

See: MIT Technology Review for energy.

Related Solari Reports

- The Oil Card

- The U.S. Plays the Oil Card

- Oil Card Geopolitics

- The Oil Card – Global Economic Warfare in the 21st Century

- Adam Trombly on Zero Point Energy

- What is Breakthrough Energy?

The success of fracking in the United States means that fracking will now go global, and so will the controversy associated with it. Watch for sparks flying about fracking from Europe in 2014.

Renewable energies continue to grow – and dramatic growth is ahead, particularly as the cost of solar continues to drop.

Renewable energy shows no signs of replacing fossil fuels anytime soon.

The growth of renewables and low cost natural gas is having a dramatic effect on utilities struggling with a high cost base. I suspect one of the goals of so called “smart meters” is to protect the utilities 2.0 business model as knowledge of renewables grow and costs decline.

See: European Utilities: How to Lose Half a Trillion Euros

Expect the challenges that utilities face to continue to grow. Also expect the focus to turn to energy storage. Among other issues, solar and wind do not create a steady flow of energy. Without an economic way to store the energy they produce to match the needs of users, renewables will continue to maintain a small market share. As significant storage breakthroughs are reported, expect new rounds of creative destruction in the energy markets and very good news for emerging markets economies where energy demand is growing.

This year, I attended the second Breakthrough Energy conference in Boulder, Colorado.

We continue to hear of many breakthrough energy technologies and of significant corporate interest in them. Whether or not there will be a move to adopt them is unknown. There is no way to tell. In my opinion, the “smart meter” network being aggressively adopted despite consumers objections indicate there is a highly centralized push to get billing meters in place before the price of energy falls significantly or decentralized options become widely available.

With the dollar on an oil standard, there is no way that energy technologies will be adopted that threaten the fundamental nature of the Anglo-American alliance’s control of the currency. Which is to say that a successful adoption of a digital currency could have a dramatic impact on the adoption of new energy technologies and the valuations of 2.0 energy companies that do not “jump the curve” to the 3.0 model.

Finally, in the fourth quarter we saw a highly aggressive

effort to promote investment in renewables, including several university campaigns to encourage endowments to stop investing in fossil fuels. Are we watching a pump of the so called “clean tech stocks?” Probably. For example, solar significantly outperformed the S&P500.

The greatest high flyers were “all things Musk” as Elon Musk continued to capture applause as America’s favorite high-tech enteprenuer. While the stock of his company Space X is not publicly traded, Tesla Motors and SolarCity are. Both outperformed the S&P this year by several multiples.

While renewables may have been the momentum stocks in 2013, it was fossil fuel that continued to support the dollar as reserve currency. Expect the same for some time to come as we move towards a more resilient model at breakneck speed.

Investment Shifts from Global 2.0 to 3.0

North American Manufacturing 3.0

The North American manufacturing renaissance is on. The question is why? Was the political pushback from the BRIC nations too unpleasant? Or does a private space industry and parts of the defense industry want to stay within its own jurisdiction to keep proprietary technology away from global competitors? Was outsourcing not everything it was cooked up to be? Or with weird weather, even weather warfare, do we need shorter supply lines? Perhaps new fabrication technology and robotics can make the enormous differences that some promise.

Related Solari Reports

- Crowdfunding, What It Means To You

- Equity Markets: The View from Silicon Valley

- A Beginners Guide to 3D Printing

- Picking Winners in the Green Tech Boom

- How the Youngest Generations Will Contribute

North America has food, water and energy. While its workforce costs are not comparable with those in the emerging markets, the spread between the two has narrowed significantly in the last two decades. As discussed above, a driving force in North America’s competitive position is clearly the dramatic increase in natural gas and domestic energy supplies and the decrease in prices relative to other continents.

It would not surprise me if this pull back into North America also represents a pull back of the Anglo-American alliance into the English speaking nations – Canada, US, UK, New Zealand, Australia as the dance between Russia, China and the US gets increasingly tense.

Reengineering the Cost-Plus Model

One of the hidden opportunities is reengineering the military industrial complex. For many decades, the defense industry has financed with the federal budget on a cost-plus model that has driven total costs significantly above what is possible. With pressure from the “fiscal cliff” one possibility is that the military industrial complex is prepared to reengineer their manufacturing process and the government prepared to reengineer their contracting and procurement models to a very new way of doing business.

If you step back and look at the financial coup d’état and the financing of what I believe are endowments that now undergird the finances of the “breakaway civilization,” another possibility is that the coup was inspired by the desire to shift a portion of the entire military industrial complex to a privatized model, in part to allow for this type of reengineering.

Certainly, it is instructive to note that in a year with significant budget cuts in defense and federal spending, the single largest contractor to the US government and the US military, Lockheed Martin, is having a gangbuster year.

US defense contractors have been trying to grow foreign sales. That may provide some support to earnings.

We would remind subscribers that the Administration has the ability to supply waivers to US corporations to relieve them of obligations to provide financial statements that comply with SEC laws and regulations. That fact is worth thinking about deeply as we watch the stock markets rise on the basis of reported corporate profits.

This waiver capacity always gives me pause when I contemplate the SEC filings and financial statements of companies that do business with large governments. My motto is that when you contemplate investing in such companies, you want to add in a significant discount to value for, as Donald Rumsfeld made the mistake of saying, “What you don’t know you don’t know.”

Applying Technology

Whatever the reasons for the move back to North America, we are watching a global push to integrate new technology into the economic process. The change, when combined with the build-out of the mobile smart device networks and the increase in global learning speeds, will accelerate change. Expect far greater change in 2014 than we have seen this year.

Let’s look at some of the technologies that will reengineer the fundamental economic process to a more networked 3.0 model from the 2.0 industrial model.

3D Printing

3D Printing is one of the new fabrication technologies that has captured the popular imagination – in part because it has the potential to dramatically decentralize the production process. To learn more about the process and industry of “changing bytes to atoms and atoms to bytes” at higher speed and lower cost, check out the Solari Report and special PowerPoint briefing prepared for us by engineer and innovation expert Onat Ekinci in October.

Lest you think that decentralized capacity cannot go head to head with Wal-Mart, think again. Check out what is available at web sites such as etsy.com and rethink the possibilities of cottage production.

3D printing companies such as 3D Systems, ExOne and Stratasys have enjoyed quite a run in the stock market this year. Lets see if their fundamentals catch up with valuations in 2014.

Robotics

Robotics fueled by improvements in artificial intelligence are moving into numerous aspects of the economy.

We recently published a briefing for subscribers on Industrial Robots prepared for us by Onat Ekinci as well.

The implications to employment are significant. Expect increases in the demand for engineers and layoffs over the next decade in everything from fast food to farm workers.

Drones

The push is on to introduce drones into US air space. The FAA is expected to publish a draft rule regulating the use of drones under 55 lbs in US air space.

Early uses will include people interested in cheap aerial footage – such as farmers and real estate agents. But online retailers lead by Amazon are planning on introducing a same day delivery system dependent on drones.

With fabrication technology making decentralized production more economic on one hand, and Amazon trying to achieve same-day delivery of fresh food to your door and the possibility that the local farmer can one day do the same, it is worth contemplating the challenges that lie ahead for Wal-Mart and their long supply chains.

It is challenging to understand how many of these changes are being integrated. On one hand we have relatively new companies leading the way. On the other hand, there is significant leadership into the 3.0 model by the companies considered leaders in the 2.0 industrial model. Check out what Deere is doing in agricultural robotics. Or what Corning is doing with integrating digital technology into glass. Over the next year, expect stock market valuations to increasingly reflect whether companies are shifting into 3.0 or not.

Also expect for some of these shifts to be quiet. Part of what is happening is that technology that was considered new 20 years ago is now becoming affordable. So high school kids can learn and use excellent CAD software. So the technology is not necessarily new rather, the integration is reaching a tipping point.

Private Space Investment

Some of the most intriguing discussions on the Solari Report in 2013 were those I had with Dr. Joseph Farrell:

As a result of these discussions, Dr. Farrell has agreed to do a quarterly Solari Report on an ongoing basis. One of my goals with this collaboration is to understand what is happening with the creation of a private space industry subsequent to the Obama Administration’s announcement on April 15, 2010 of the privatization of aspects of the US space program. What does it mean in the US and globally? What does it means to the current condition and future of the human race? What does it means to the investment outlook over the next decade?

Among other things, SpaceX’s successful rendezvous with the International Space Station in 2012 under contract to NASA have proved that private industry can perform numerous functions in space at significantly reduced cost, even before the full integration of the technological innnovations underway.

This was the same year that a group of Silicon Valley billionaires along with Ross Perot, Jr and Richard Branson announced their investment in Planetary Resources with a plan to mine Near Earth Asteroids. So we now have the high tech entreprenuers completing for turf in outer space:

- Jeff Bezos has founded Blue Origin

- Elon Musk has founded Space X

- Richard Branson has founded Virgin Gallactic

- The Google guys are backing Planetary Resources

When I was on Wall Street, partners who cashed in on big money bought racehorse stables or large art collections. Now they start companies that take celebrities to outer space and use advanced robotics to do space mining. Think about the change in outlook this implies. To quote Musk from recent interviews:”There’s a fundamental difference, if you look into the future, between a humanity that is a space-faring civilization, that’s out there exploring the stars … compared with one where we are forever confined to Earth until some eventual extinction event.”

“Given that this is the first time in 4.5 billion years where it’s been possible for humanity to extend life beyond Earth, it seems like we’d be wise to act while the window was open and not count on the fact it will be open a long time.”

Throughout 2013 we have seen an explosion in the popular print, TV and movie media and in fashion designed to interest the general population in space. For example, Chanel’s new watch is called the J12 Moonphase Watch.

For one indication of the popular interest in traveling to outer space, in 2013 200,000 people signed up for a one-way trip to Mars.

That is approximately double the number of people who signed up for Obamacare in its first month.

The more unusual aspects aside, one of the reasons to invest in sub-orbital platforms and greater activity in space is the move to digital platforms. The build-out of wireless networks and the Internet increases the importance of satellite systems. Expect that infrastructure to grow. China is building out its year-old Beidou satellite navigation system as a rival to the U.S. Global Positioning System (GPS) and Russian GLONASS. It expects to grow from 16 satellites to 30 by 2020 as coverage expands from Asia Pacific to one with global reach.

A global satellite system is an essential component of maintaining a global currency.

Bottom line: expect space investment to continue to grow in 2014 and for some time to come. As it does, beware the agenda of space programs to replace the centralized agenda of warfare programs. See blog post on The Report from Iron Mountain.

Work-Arounds Are Everywhere

As more and more money shifts from 2.0 to 3.0, we can expect governments in the 2.0 model to push harder for ways to cover their overhead rather than reengineer into a 3.0 model. As that happens, we will see more innovative work-arounds. Not just the traditional black markets and underground economy, but very clear steps to simply cut them out of the flow.

Obamacare is designed to incentivize many of such workarounds in the health care area. We are seeing doctors leave the practice of medicine in disgust, and then proceed to create medical devices that will cut out the traditional medical establishment entirely.

For example, note these comments from former Senator Bill Frist’s Health Care Industry Outlook for 2014 in BusinessWeek:

“Traditional technology in health care drives up the cost, just about across the board. Doing heart and lung transplants or using artificial hearts or stents—all that drives costs up. Technology today is driving the costs down. My iPhone can do a full ECG, not just a pulse rate. That’s instead of a $200 ambulance ride to the hospital, a $200 admission fee, a $150 charge for the ECG, and a $200 over-read. Now I can do it for free in 30 seconds right here on my phone.”

The Interviewer then asks: But is it a comparable quality?

“Yes. If you look at AliveCor, which is the name of the heart monitor on my iPhone, it’s been cleared by the FDA to record single-channel ECG rhythms. It’s a clinical-quality monitor. Is it as good as the standard ECG monitor you’ll find in an emergency room? No. But for 90 percent of the heart disease that an ECG in the hospital picks up, this will pick it up, too. That’s transformative. Another example is in the laboratory space. In the next 12 months you’ll see a technology where, instead of having five tubes of blood drawn by a trained phlebotomist in a clinic, with the laboratory’s blood then sent to New Jersey to be run on a mass spectrometer, you’ll be able to do that same test with a few drops of blood from a finger prick. Instead of going to a lab, you’ll go to a drugstore. You’ll be able to use it to get blood from patients in long-term acute-care hospitals, instead of drawing blood from those central lines that people get infections from. It’s cheaper. It’s less invasive. And that technology was devised by electrical engineers in Silicon Valley and not by doctors at Vanderbilt Hospital or an HCA [Hospital Corporation of America] (HCA) hospital. It was figured out by some very smart Ph.D.s outside of the health sector at a startup called Theranos. That’s the sort of disruption you see. Somebody might come back and say, “Well, the laboratory space is only 3 percent of the $3 trillion spend.” That’s true. But that 3 percent spend affects 8 out of every 10 clinical decisions being made.”

A fundamental goal of Obamacare is to incentivize technology companies and private healthcare providers to radically reengineer labor costs out of healthcare. In part, controls placed on hospitals and doctors may be designed to manage their objections as their economic opportunities and income are significantly reduced over time.

The Digital Heartland

For many years, advanced technology was what happened at MIT or in Silicon Valley. Now it’s about what is shifting into the heartland. We are talking about integrating advanced technologies and reinvigorating some of the most basic aspects of our infrastructure.

For example, lets look at railroads.

The investment into railroads in North America has been significant over the last decade. Warren Buffet bought into Burlington Northern. Fortress bought into Rail America. Then the Carlyle Group bought into Genesee & Wyoming Inc. when they bought Rail America, giving Fortress a double on their money. Then Buffet bought all of Burlington Northern, taking it private. I started to hear about what Burlington was telling its employees about the growth planned for the company. I saw the people they were hiring and the money they were paying.

If you are going to build domestic oil and gas self sufficiency and exports and build a resilient, distributed high-tech manufacturing base and dramatically increase production while lowering costs, you are going to need increased low-cost transportation that can perform on a highly reliable basis even in extreme or volatile weather conditions.

That’s railroads, folks.

You can see similar stories in housing, whether it is houses that you can build for yourself at a reasonable cost or visions for building houses quickly with jumbo 3D printers.

Perhaps one of the most intense competitions is in digital highways and cars, particularly autonomous cars. Nissan and Mercedes have now pledged to produce self-driving cars by 2020. Mercedes is touting its smart-driving system. BMW just produced an all electric i3 car that weighs 600 pounds less than the Nissan Leaf thanks to carbon fiber.

For many years, software has been the place to be. If you look at what is happening in the heartland, hardware is in the process of getting a lot more intelligent and of interest to investors.

Global 2.0 Downshifts

The developed world is populated by high-overhead government, corporate enterprises and not-for-profit organizations that continue to maintain and manage the liabilities created during the post WWII industrial phase. Through the black budget and during the financial coup d’état, significant assets have been shifted into new entities, many of which are operating in the 3.0 models.

Many of these 2.0 organizations have not adapted to new ways of doing things. They are struggling to adapt and struggling to manage the slow and steady debasement and disappointment associated with the remaining liabilities. Some will manage their way through, as they change. Some will fail—some slowly, some quickly.

Many of these 2.0 organizations have not adapted to new ways of doing things. They are struggling to adapt and struggling to manage the slow and steady debasement and disappointment associated with the remaining liabilities. Some will manage their way through, as they change. Some will fail—some slowly, some quickly.

- Utilities will struggle to maintain profit margins as renewable energy options proliferate

- The French government will look for ways to tax YouTube to finance their movie industry

- Hollywood will continue to push for Internet controls as their market share is threatened

- The US government will continue to levy new taxes to offset the resources and assets transferred out through the backdoor to the black budget or to please corporate lobbyists

One of the most important strategic questions for citizens in the developed world is how to manage our complex personal entanglement with these institutions.

Under the law, our assets are often collateral for outstanding liabilities. For example, general obligation municipal bonds have a call on the ad valorem taxing power of the municipality. This means citizens are on the hook to creditors who have the power to demand that taxes be raised to satisfy obligations.

Related Reports

Many individual assets represent liabilities on the larger institutions’ balance sheets. So, retirees are counting on health care, pensions and social security for which the larger institutions do not have full funding.

Part of “Break Away” means doing what we can to receive what is owed to us without losing time or experiencing emotional drain when obligations to us are abrogated or debased. It also means organizing our economic lives to take advantage of opportunities in the 3.0 model without being fooled about the fact that significant reinvestment flowing into 3.0 represents resources shifted illegally away from us. Many of us will find ourselves working to earn or attract our own money back. Many baby boomers will watch their enemies finance their children’s start ups with capital that has been stolen from them, while their children point to their capitalization as proof that the system “really works.” Think of this as a leveraged buyout.

The Bond Market

In the mix is the fact that the 3.0 equity capital is going to be much more valuable as a result of events in the bond market.

For decades, corporations have looked to sovereign governments and central banks to guarantee markets for them and to appropriate vast expenditures which have fueled corporate profits and channeled significant resources into the black budget.

This flow involving trillions of revenues into large corporations has been financed by sovereign governments in the developed world borrowing significant amounts of money in the bond market. This was possible as falling interest rates supported the preference of global investors for fixed income investments. Falling interest rates have been made possible by the global financial liquidity, in turn, made possible by digital communication and software systems, as well as the creation and growth of the derivatives markets. In one sense, the platform that made falling interest rates possible was satellite systems and the Internet.

One of the disturbing aspects of life in the United States is the extent to which most Americans do not understand the dependency of household and corporate incomes and state and local government revenues on the federal budget and the federal currency creation and borrowing mechanisms. Expect the ongoing fiscal cliff negotiations to slowly, steadily educate Americans to the extent to which both theirs and their neighbors’ financial condition and the corporate profits that drive stock market valuations depend on federal borrowing. Fundamental economics are going to reassert themselves as the air goes out of the bond bubble which has been financing deficit spending.

This last year may have marked the end of the long-term bull market in bonds as interest rates rose.

Holders of long term Treasuries have lost 10-15% of their principal value while US equity markets soared in 2013.

Given the rise in yields during 2013 and the announcement from the Fed that they will start to taper QE in 2014, all eyes will be on interest rates in 2014. If rates start to rise quickly by any significant amount, there may be trouble ahead. The faster interest rates rise, the greater the pain to institutions struggling to manage outstanding debt and retirement liabilities in 2.0.

In short, a failure to manage interest rates could compromise slow burn economics and centralized control. Whatever happens, the value of 3.0 equity capital free of 2.0 liabilities is going to be increasingly more valuable as a result of the transition in the bond market.

The Vatican

Perhaps the most dramatic story of an institution shifting out of 2.0 to adapt to a 3.0 world during 2013 was that of the Vatican. The Vatican and the institutions, endowments and networks within their affiliated umbrella are arguably the most powerful financial and investment network in the world. However, their intelligence networks in the developed world have been bested by the juggernaut of the NSA-Telecoms-online social media and search engines. As a result, they have been rocked by the financial drain of the pedophilia scandals (aka control file systems) and the resulting alienation of millions of former members who are no longer paying tithes. Their growth opportunity is in the emerging markets and that requires a change in leadership and a change in numerous policies. Enter a new Pope from Latin America.

See: Special Solari Report with Dr. Joseph Farrell

Targeting of the Tax Havens

As significant funds have moved out of developed nations and into tax havens, sovereign governments have experienced a steady decline in taxes, including corporate taxes.

As tax revenues have fallen, Treasuries and legislators have become increasingly focused on how to extend their jurisdiction to move funds in the tax havens back within their taxing and regulatory base.

For the last few years, the US Department of Justice has lead a campaign against the Swiss banks, ultimately leading to a Swiss capitulation to provide information to US authorities about US citizens holding assets in Switzerland. Indeed, many Swiss money managers have now either registered with the SEC or asked US investors to depart. Perhaps the most painful part of this capitulation in 2013 was the Department of Justice’s targeting and destruction of Wegelin & Co, the oldest operating private bank in Switzerland which had been particularly eloquent in its criticism of American corruption.

With the mother of all private banking centers under DOJ’s wing, the G-7 in 2013 announced a policy of targeting the tax havens. Americans who were concerned about their 401k plans becoming targets of a Congress looking for funds to finance government deficits came to realize that assets in the global tax haven system dwarfed theirs by many multiples.

The G-7 announcement followed the debacle in Cyprus—arguably an early, messy prototype of harvesting funds in a tax haven. The Cyprus central bank was ordered to sell its gold. Dumping this gold on the market was probably part of what made April 2013’s plummeting gold price occur.

Literally one day after the G-7 announcement, a swiftly convenient scandal at the IRS removed the existing leadership, making way for John Koskinen to be appointed the new IRS commissioner, with his appointment confirmed at the end of the year. There are several important functions that Koskinen can fulfill. Working with DOJ and Treasury, one is the extension of jurisdictions over tax haven deposits and assets. The other is to make sure the IRS databases do not compromise the shift of assets to 3.0 but are used to ensure political obedience while the 2.0 liabilities are debased.

Expect a round-up of capital from the global tax havens to keep the G-7 sovereign governments financed and to shift funds into their bond and equity markets. If gold sales take place in the global tax havens as they did in Cyprus, the central banks should be able to maintain gold prices in the $1,000-$1,450 range in 2014.

Obamacare

One of ugliest downshifts this year was the implementation of Obamacare. A group of House Republicans did their best to warn the American people and were slaughtered in the polls for trying, leaving Obamacare to proceed in October.

Millions of Americans discovered that they could not, in fact, keep their existing policies. The private insurance industry took the opportunity to shed aging baby boomers from their insurance book or otherwise radically reengineer deductibles and/or how liabilities would be shared. Those looking for insurance got a rude awakening when they read the new terms and conditions. People began to consider divorce in order to reduce household income so that they could afford health care insurance.

This process has begun to trigger serious questions about the fundamentals of the health care system in the United States, where costs are generally double that of other countries in the developed world and are rising as the population ages. The general population is beginning to realize the hidden agendas involved, including an end of privacy and the centralized control of doctors and heath care professionals.

Launching Obamacare in the fourth quarter of 2013 destined the retail industry to have a dreadful Christmas. Essentially, as the American middle class has been squeezed for more than a decade by the slow burn, millions of families have only $100-$1,000 a month in discretionary income. Obamacare grabbed it all … just like that.

This means thousands of companies that competed for that income, such as casinos in Atlantic City and Las Vegas, have been hit by the dog wagging the tail upon which their business depended. Millions of consumers have seen 100% or more of their discretionary income eliminated virtually overnight. And they have received a clear message – one which when integrated with the message of the housing bubble and bailouts instills fear, hoarding and other deflationary behavior.

Related Solari Reports

The positive in all of this is that it brings us back to fundamental economics. Suddenly, the incentives to take better care of ourselves are increasing. If we are on our own or have to pay cash for medical care, we cannot afford to get sick. And the incentives for 3.0 companies and entrepreneurs to create businesses that provide low-cost work-arounds are exploding.

For example, check out crowdmed.com, a web site that offers rewards for medical detectives to solve challenging medical problems for patients who have not been able to find successful therapies in the traditional medical model.

[arve url=”http://www.youtube.com/embed/OhjV7KIWCBk?rel=0″ width=”420″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

While these efforts can increase the tools that individuals have available to manage their own health care, they also run the risk of creating new rounds of unemployment. A significant portion of health care costs is labor. If ways are found to engineer labor costs down to the percentages in other industries that have adapted the 3.0 model, we can expect a significant reduction in health care employment and compensation.

In many areas, consumers will discover they can get better service and better treatment from state health care exchanges. Because state operations are more effective at delivering services, popular opinion will support greater decentralization of government programs.

Also expect medical tourism to rise and more Americans to live abroad in jurisdictions that provide excellent health care as low as 20% of US costs.

US Pension Funds

One of the important struggles among the 2.0 institutions will be the continuing battle to control or influence their remaining pension fund capital. There is an extraordinary amount of money in US pension funds, both corporate and union, as well as state and local government. There has been quite a campaign against state and local pension funds in 2013, one that exaggerates their funding shortfalls and management failures. Presumably the goal is to give Washington and Wall Street more power and control, which is the opposite of what is needed. People need to prevent Washington and Wall Street from draining or raiding these capital pools any further.

Trade Agreements

This last year was a year in which numerous international trade agreements got stuck in the mud. The Doha round of GATT has ground to a halt on Indian farmer suicides and on the growth of global consciousness regarding the fundamental insanity of the GMO model and corporate patenting of seeds and life. Not much got done. I suspect it’s not unrelated to the Western media campaign hounding India about caste systems and rape and discrimination of women.

Negotiations of the Trans-Pacific Partnership continued with several invaluable leaks of the sections being negotiated. No final deal was achieved in 2013.

Finally, Codex is stuck in the mud as well.

One possibility regarding the pull-back into operations in North America is that the Anglo-American alliance is having difficulty implementing the global seed and food control they have been hoping for.

This inability to achieve control of the food supply has potentially powerful repercussions for the development of a global currency, particularly given balkanization of the Internet on the heels of the NSA scandal this year. The bottom line is that the global control systems are not yet in full effect and the struggle to keep them from clicking into place is powerful.

Fundamentals Matter

The challenge that the 2.0 organizations face is that fundamentals matter.

With computers and networks, who needs to send money to Washington and have it come back through a large and highly complex process involving distant bureaucracies and layers of state and local government and private contractors? Why pay Washington to pay a corporate contractor to do something for $150 an hour with outsourcing abroad that could be teleported into my community and done for $25-50 an hour that would eliminate the need for one family to have food stamps and unemployment? Such questions become more important now that the bond market is no longer available to pay all constituents off with fundamentally un-economic largesse, while trillions disappear into the black budget.

Congress, for example, declined to extend emergency unemployment benefits at the end of 2013. This cuts deeply into the ability of households to continue to function and to spend. It demonstrates that a part of the shift of assets from 2.0 to 3.0 is to transition economic value from labor to automated systems that provide profits for the very few. One could say that this is increasing economic profits. However, it is not. It is simply centralizing profits in a system that shrinks total economic value in highly wealth-destructive ways.

As cuts continue and retirement obligations are debased, expect a growing consciousness about fundamental economics in 2014. One of the interesting tests of that consciousness will come in the mid-term elections, making the Congressional, gubernatorial and even local races quite interesting.

This is one of the reasons why hundreds of millions of dollars (if not trillions) in the 3.0 model will be shifted into private equity investment during the next few years and capital flows will be directed into the equity markets. As fundamental economic consciousness grows, better to engage the general population in creating new wealth in the 3.0 model. The alternative might see them take the time to develop a complete picture of the current financial ecosystem and attempt to renengineer the controls sufficient to improve their standing regarding 2.0 liabilities and the retirement benefits owed.

Better to have them think we are bankrupt and about to collapse, or have them get to work within the 3.0 boom.

Money & Markets

|

Index

|

12/31/2012 | 12/31/2013 | % Change |

|---|---|---|---|

| S&P 500 | $1,426.19 | $1,848.36 | 29.6% |

| DJIA | 13,104.14 | 16,576.66 | 26.5% |

| Russell 2000 (IWM) | 82.96 | 116.34 | 40.2% |

| MSCI EAFE (EFA) | 55.25 | 67.10 | 21.5% |

| MSCI Emerg. Mkts (EEM) | 44.35 | 41.80 | -5.8% |

| Barclays Agg Bond (AGG) | 107.96 | 105.83 | -2.0% |

| Barclays H/Y Bond (JNK) | 37.76 | 39.97 | 5.9% |

| Gold (oz.) | 1,657.50 | 1,204.50 | -27.3% |

| Silver (oz.) | 29.95 | 19.50 | -34.9% |

| US Dollar Index | 79.77 | 80.04 | 0.3% |

| Commodities-Reuters/Jeffries CRB Index – $CRB | 295.01 | 280.17 | -5.0% |

| Baltic Dry Index | 699.00 | 2,277.00 | 225.8% |

| 10 Year Treasury Yield Index – $TNX | 17.56 | 30.26 | 72.3% |

| 30 Year Treasury Yield Index – $TYX |

29.52 | 39.64 | 34.3% |

Equities “Crash Up”

For those of us who expected a correction in the equities markets, 2013 was full of surprises.

Results were so bullish that bearish hedge fund manager Hugh Hendry finally threw in the towel, saying, “I cannot look at myself in the mirror; everything I have believed in I have had to reject. This environment only makes sense through the prism of trends.” Hendry’s December newsletter to investors makes the case that the greatest risk is not being long.

Fundamentals matter. But when central banks print money and the bond bull is over, equity markets crash up.

The year started with a new form of yen carry trade, with Abenomics goosing the Japanese economy with its own form of quantitative easing. The result was a Nikkei up 56% for the year.

The S&P500 closed up 30%, the largest annual advance since 1997. Small caps were the star performer in the US markets as the Russell 2000 rose 37%.

One of the things that kept the US markets going was share buybacks. For the 12 months ending September 30, 2013, companies bought $445.3 billion of shares. As of 12/24, the WSJ reported that the S&P500 Buyback Index, the 100 stocks with the highest buyback ratios was up 45% this year.

In the US, the consumer discretionary sector was the strongest sector, followed by health care, industrials and financials.

The US IPO market was strong, with 222 companies going public. That is the largest annual number since 2000 when 406 companies went public. The amount of money involved, however, is close to the total amounts seen during the tech bubble with over $50 billion in capital raised in the US from IPO’s in 2013. Companies going public represented the wider economy with 22% coming from health care and biotech, 18% from technology and 11% from energy. The IPO pipeline for 2014 looks strong.

If you looked deeper within the US market, one dynamic was money leaving 2.0 companies that were not reengineering fast enough and shifting to 2.0 companies that are leading the change or to newer 3.0 companies. In December, Ford’s market valuation was equivalent to $30,000 per car produced. Tesla Motors was $750,000 per car produced. Or check out this chart from Henry Blodgett’s excellent presentation The Future of Digital, to understand why Hollywood is steadily losing market capitalization to Silicon Valley.

European equity markets lagged those in the US for the first half of the year, and recovered some in the second half, finishing the year up 18%.

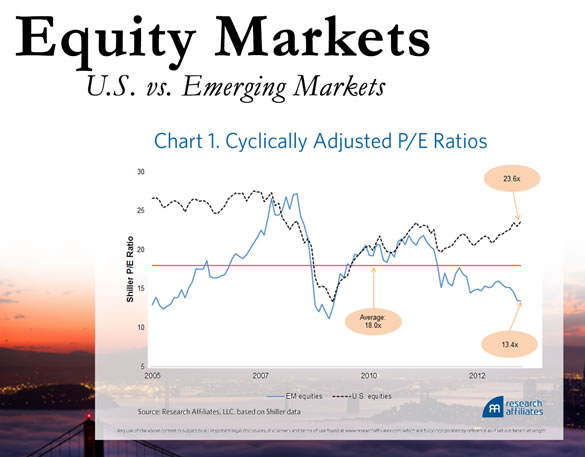

That said, all equity markets are not equal. Emerging market equities closed the year down (5.8)% as G-7 called its capital back home. As it did so, the posturing of the BRICs softened, at least until the NSA revelations underscored that their leaders’ cell phones were being tapped.

Looking forward to 2014, the question is whether or not the bull will continue.

We are in the second year of the presidential cycle. As Chuck Gibson pointed out recently:

“According to the Stock Trader’s Almanac, the two first years of the Presidential four-year cycle are usually the worst with the last two usually the best. Bear markets usually occur during the first two years. Since 2013 (the first year of this term) was so strong, historical odds for 2014 (the second year) to suffer a correction are pretty high.”

In the US, a great deal of corporate profits have come from reducing labor and automating. Given the reengineering of health care and the introduction of robotics, there are far more labor reductions coming. Obamacare should accelerate this as it puts pressure on small business. Pressure from the bond market is going to cause Congress to try to cut the flow of government subsidies, including unemployment, food stamps, welfare and disability.

As household income is reduced and expenses rise, retirement arrangements are debased or abrogated by politicians and bankruptcy courts, and manual labor is squeezed out, the question is how we will avoid a descent into high-tech feudalism. We are reminded of Henry Ford’s comment that he paid his workers well so they could afford to buy the cars they made.

Another source of corporate profits has been the steady decrease in corporate contributions to taxes. Whether corporations can continue significant tax avoidance in the face of corporate and government 2.0 liabilities remains to be seen.

Stewart Thompson at Graceland Updates argues that the pressure is on companies to put their hoards of cash to work, quoting John Pender in the Financial Times on December 31:

“For at least a decade and a half, cash has progressively increased its share of the American corporate balance sheet, to the point where U.S. quoted companies have turned into the Scrooges of the global economy…. Such is the scale of this cash pile that the U.S. corporate sector must have been partly responsible for the surge in demand for safe assets and the decline in interest rates that fueled the U.S. housing bubble.”

Related Solari Reports

- Equity Overview with Chuck Gibson: Emerging Markets 101

- Equity Overview with Chuck Gibson: Why Dividends Matter

- Secular Trends in the US Equity Markets

- Equity Markets: The View from Silicon Valley

Stewart argues that this means that “the probability of a turn up in money velocity in 2014 is growing, because corporate spending is likely to grow” which would reverse the trend of the collapse in M1 velocity that has occurred since the Fed’s QE program began.

I would say it differently. Now that the criminal liabilities associated with the financial coup d’état have been extinguished, the reinvestment of funds shifted can accelerate into the 3.0 models without creating new risks and factionalism.

There are numerous issues to be dealt with as this happens. One of the reasons that corporations have been borrowing to fund share buybacks is because cash is offshore and repatriation involves tax liabilities.

Policy makers are considering mandating 401k plans for small business. This expense, along with a rising minimum wage and Obamacare, means that small businesses that do not transition from 2.0 to 3.0 are unlikely to survive. Except another round of tech companies and large corporations to target these markets for reengineering.

Finally, don’t be surprised if proposals to privatize Social Security begin to make the rounds again. Shifting these funds into the equity markets will help continue the flow of funds to the crash up scenario and may be a way of negotiating a truce over Social Security between 2.0 and 3.0.

The big wildcard in the equities markets over the next decade is one that Chuck Gibson underscored this year in his Equity Overview. Traditionally, Americans are unique in the percentage that own equity investments, whether directly or through pension funds. Traditionally, global equity ownership is limited to institutions. Will the rise of the middle class in the emerging markets significantly shift the percentage of retail investors who invest in the equity markets?

I believe the answer is “yes” and that will make for a very interesting time in global equity markets over the next two decades.

Commodities

Most commodities fell in 2013, with the Commodities-Reuters/Jeffries CRB Index down (5.1)%. Lower prices on commodities supported growth in corporate earnings. For example, note the performance this year of Starbucks as the price of coffee fell precipitously. If global growth increases and interest rates rise, commodities are likely to rise with them.

Bonds

If there is a spoiler in the equity picture it is the fixed income markets and how the broader markets will handle a continued rise in interest rates.

Related Solari Reports

The strategies that helped bring interest rates down over the last decade could now bite back if rates continue to rise. The interest rate derivatives market is now the largest derivatives market in the world. The Bank for International Settlements estimates that the notional amount outstanding in June 2013 was US$561 trillion for OTC single-currency interest rate derivatives.

Throughout the year, we have seen continued debate as the Commodities Future Trade Commission moved to implement swap regulations as a result of Dodd-Frank – a difficult job at best. As the CFTC is successful, the resulting transparency and regulation will support a wider understanding of these markets.

The global financial institutions and regulators have never before managed a large derivatives book during a period of a sustained rise in interest rates. We are in uncharted territory. If there is a reason the slow burn scenario breaks down, the impact of rapidly rising interest rates on the derivatives book is likely to be the cause.

The global financial institutions and regulators have never before managed a large derivatives book during a period of a sustained rise in interest rates. We are in uncharted territory. If there is a reason the slow burn scenario breaks down, the impact of rapidly rising interest rates on the derivatives book is likely to be the cause.

For several years, I have said that if the slow burn does not hold and interest rates start to rise too quickly we will not have a collapse, rather we will have a war. That is because the size of the interest rate derivatives and their concentration in the large financial institutions functions as a financial doomsday machine. Interest rates will stay low or rise slowly because there is no other choice. If they start to rise too quickly, the financial and political leadership will do whatever has to be done (including bank bail-ins) to bring them into line with a slow burn scenario. If they can’t, the practical alternative is to start whatever wars are required to force the capital flows necessary.

Another story that continued in the headlines during 2013 was the LIBOR scandal regarding the setting of the LIBOR rates by the large banks. My take is that the Fed and the central banks needed a tighter reign on this rate setting mechanism if they were going to keep interest rates in check.

Municipal bonds had tough year. According to a recent WSJ article:

“Based on the data so far this year, municipal bonds are set to deliver their worst annual performance since 1994. After giving investors a 10.7% return in 2011 and a 6.78% return in 2012, municipal debt returns have fallen 2.58% this year, according to a municipal bond index by Barclays.”

US municipalities cannot print currency and are required by law to balance their budgets. Drops in household income impact their tax base, harming their bond credit, and rising interest rates raise their cost of capital. If interest rates continue to rise, the municipal bond market will continue to feel the pinch, squeezing municipal government budgets. Again, the pressure to reengineer using 3.0 technologies will be significant.

Rising interest rates also made this a difficult year for the real estate industry and REITS, which traded off as interest rates rose, and canceled or slowed down IPO plans for investors who have been rolling up single family real estate. The bank foreclosure portfolios held significant inventory off the market. Was this part of the deal with the fed buying up the mortgage backed securities? I assume so.

Will interest rates continue to rise in 2014? Expect rates to rise. If there were signals to indicate that they will, it was reports at year-end of the number of large financial institutions that are significantly reducing their fixed income staffs. They anticipate significantly less volume and profitability in the fixed income divisions as the Dodd Frank regulations are implemented in the United States.

Because the bond market is the head that wags the equity market tail, Chuck Gibson will join me at the end of January for our first Solari Report Equity Overview of 2014 to discuss what is happening in the bond market and what it could mean to the equity markets in 2014.

Currency

The US dollar continued strong this year, as the Japanese drove the yen down and the BRIC nations continued to create payment mechanisms outside of the dollar system.

The Chinese currency passed the Euro as the second largest trade settlement currency. In December, Bloomberg reported:

“China’s yuan overtook the euro to become the second-most used currency in global trade finance after the dollar this year, according to the Society for Worldwide Interbank Financial Telecommunication.

The currency had an 8.66 percent share of letters of credit and collections in October, compared with 6.64 percent for the euro, Swift said in a statement today. China, Hong Kong, Singapore, Germany and Australia were the top users of yuan in trade finance, according to the Belgium-based financial-messaging platform.

The yuan had the fourth-largest share of global trade finance in January 2012 with 1.89 percent, while the euro was the second-biggest at 7.87 percent, Swift said.

The U.S. dollar led all currencies with an 81.08 percent share of letters of credit and collections in October, down from 84.96 percent in January 2012, according to data compiled by Swift. The yen slipped from the third-most used global currency to fourth over the same period, declining from a 1.94 percent share to 1.36 percent.

As the dollar position as global reserve currency remained secure for now, the efforts to engineer a global digital currency made significant headway with the development of Bitcoin.

Bitcoin received enormous promotion from sections of the alternative media on the theory that it was truly anonymous. That’s hogwash. I spent the second half of the year trying to talk Solari Report subscribers out of buying Bitcoin as it took up to 50% swings in price. If you want to help Mr. Global prototype digital currencies, have at it. Most chilling is the potential to marry Bitcoins with gold. It is what I would do if I were Mr. Global. With the financial coup d’etat finished, moving to a sound currency protects your winnings and brings financial accountability that advantages you and your holdings. It is a way of shifting back to a system that reflects fundamental economics now that you control the lion’s share of the capital.

Bitcoin Blog Posts and Commentaries

- The Bitcoin Pump is on Again

- Royal Mint In Talks To Create Gold Backed Bitcoin

- Bitcoins: p A Fully-Compliant Currency The Government Can Love

- Regulators See Value in Bitcoin, and Investors Hasten to Agree

- IRS Takes A Bite Out Of Bitcoin

Meantime, I am sticking with insured bank deposits and coins.

The Bitcoin splash reminds us that the build-out globally of the mobile systems with smart phones and tablets is going to have a dramatic impact on currency and payments systems.

This is an area you want to keep an eye on. Billions of people are shifting into our “field.” I am reminded of one of my favorite quotes from Michael Ventura as he describes the impact of sharing a psychic space with a large population. He says, “We are standing in the storm of our own being.”

When eight billion people share one field, the risks created by currencies and payment systems that lack integrity increase exponentially.

Precious Metals

After twelve years of outperforming the equity markets, gold and silver finally had a bad year. Indeed, it was a really bad year. If you had sold $1.00 of gold at the end of 2012 and bought the S&P500, by year-end you would have $1.30, as opposed to $0.72. That is a $0.58 spread.

I will be covering the precious metals market is greater depth next week in the first Precious Metals Market Report of the year.

In a nutshell, what I will say is that the number of gold exchanges are growing around the world, as lower prices allow a significant number of new buyers to join the physical gold and silver market.

All of these signs and more imply long term plans for gold to remain at the heart of the global trade and settlement systems, if not become a part or option in the new digital currency systems. That argues that gold and silver remain in a positive primary trend.

However, given the continued regulatory efforts in countries around the globe to keep prices in check (taxes in India, postal rules in France), the potential for bank bail-ins and targeting of the tax havens, my expectation for the gold price is that significant rises in 2014 are unlikely. Traditionally, rising interest rates are not good for gold. If rates do rise, prices may fall as low as 1,000 before a bottom reasserts and gold starts to rise again.

My assessment is that the primary trend will reassert. There is a chance I am wrong. I disagree with the gold bugs that a bear market is impossible. There are numerous wildcards that could drive prices down for some time to come.

For example, let’s look at the mining stocks which were down (54)% this year. A comparison of the timing of the fall of the mining stocks with the success of the SpaceX launches for NASA and the announcement of private plans to mine Near Earth Asteroids with mining robotics and other key dates of the blossoming global space industry will give an observer pause. Significant capital is moving into mining in outer space while significant capital is flying out of mining on earth. A coincidence? Maybe, maybe not. Disinformation while insiders scarf up mining stocks for cheap? Maybe, maybe not.

What is true is that new technology and innovation have the potential to radically improve the fundamental economics of our situation. As those economics kick in, it has the potential to lower the risks that inspire demand for gold.

One of the arguments promoted to support a dramatic rise of the gold price in 2014 is the large shift of physical gold out of the gold ETF and western depositories and into China.

While clearly large physical inventories are moving east, we do not know who ultimately owns and controls these inventories. It may be the Chinese. It may also be the Chinese acting as agents for one or more other parties.

With G-7 targeting the tax havens, for all we know the Breakaway Civilization has decided to move their gold stores to Tibet under Chinese protection. Remember, they don’t care what the retail price is. A low price is just a chance to accumulate more while it significantly eases the pain experienced by the US as they arrange to return gold holdings to global central banks. Whatever the truth is, a growing middle class in India, China and the Pacific Rim is bullish for gold.

Read What Percentage of My Assets Should I Hold in Precious Metals?

Private Equity

Private equity will be one of the most interesting areas to watch in 2014.

Expect significant reinvestment of 3.0 pools of capital in startups and early venture, particularly in new technology. If the strength in the IPO markets continues, pension funds and institutional investors will be encouraged to shift capital, as well.

Moving energy towards a more resilient model, rebuilding North American manufacturing or building out an aggressive private effort in space — all of these require significant new capacity and the investment in that capacity will offer significant opportunities for entrepreneurs.

The SEC is expected to issue the final crowdfunding regulations in 2014, which should facilitate more equity investment in small business and microventure.

At the end of 2013, the SEC raised the minimums that can be raised under Reg A to $50MM, which should significantly speed up the private equity pipeline.

The P/E ratios in the US market are currently high by historical standards. However, it is interesting to note that they have gone much higher during periods in which significant new technology has been introduced.

That cannot happen without a significant increase in private equity activities to incubate and develop the companies that will grow into IPOS and expand the number of companies in the stock market. That is a number that has been shrinking in over the last decade. That growth needs to turn positive if we are to remain a strong economy.

The Solari Report published a special report and a Solari Report on Crowdfunding during 2013. I plan to cover the new regulations when the SEC promulgates them in 2014.

If a push develops to mandate 401ks for small business, let’s hope communities create options for a portion to be reinvested in community venture. Ditto with privatizing Social Security. If these accounts became eligible to invest in prudent vehicles to finance small and local businesses as they adopt 3.0 technologies, the economy could shift into a new entrepreneurial phase.

Whatever happens, the end of the bond bull and the shift of capital into 3.0 companies and technology is going to shift the global economy towards an equity model. This will have an enormous impact on both our economy and culture.

Housing

Related Solari Reports

I said last year that the Housing markets would be strong where the economy was strong and weak where the economy was weak. That is what happened. Expect the same this year. Areas targeted for 3.0 reinvestment will have very strong housing markets. Areas that remain in the 2.0 economies will be weak, particularly if interest rates rise.

And?

- Expect the minimum wage to rise in numerous states and nationally.

- Expect discussion to get serious about moving back the retirement age under Social Security.

- Expect Model 2.0 governments to “double down” on coercion. Expect increased enforcement on taxes and any activities that generate fees, fines and asset seizures that will help finance government budgets.

- Expect pressure on Congress to create a two year solution to debt limit crises that will delay any more debt limit squabbles until after the next Presidential election. And downward pressures on financial markets if they do not.

- Expect the pressure on your time to increase as more and more governments and companies shift functions to a “do it yourself” model, despite increased complexity.

Selling Friendly Fascism 3.0

NSA surveillance systems are 2.0. The most dangerous face of fascism is the 3.0 flavor.

In friendly fascism 3.0, we voluntarily keep our intelligence agency dossier up-to-date — we just call it social media. We pay for a surveillance and tracking device that we carry with us. We just call it a smart phone. We pay for the utility services that put a “smart meter” on our home that allows the utility and the surveillance systems to track and record our daily activities and patterns.

Related Solari Reports

- Internet Freedom: Your Rights in a Digital World

- Entrainment, Subliminal Programming and Financial Manipulation

- A Passion for Privacy

The critical thing to understand about friendly fascism 3.0 is that it is operated by private companies and private investors whose computing and artificial intelligence resources give them the ability to harvest actionable financial intelligence from the information flows of millions, even billions, of people.

This invisible machinery is about to get an enormous infusion of invasive power with the introduction of drones on scale in US airspace and robotics throughout the economy.

Add this to recent developments in DNA, nanotechnology, brain research, computer power, aerosol vaccines and trans-humanism and, well, you get my drift. Friendly fascism 3.0 is on the verge of moving completely and psychotically out of control.

If I did not have a powerful faith in the love of God and the fundamental intelligence and decency of the human race, I would be worried.

Beware technology. Use these tools with discernment. Ultimately, they feed the most intimate information about you and those you love to people who believe in slavery.